🏆 Best Dividend ETFs for TFSA in 2025 (Canada): Yields, Fees, Distributions & How to Invest

Updated August 14, 2025 • 14‑minute read • Canada TFSA

Introduction: Why the Best Dividend ETFs for TFSA in 2025 Matter

For Canadian investors, the Tax‑Free Savings Account (TFSA) is a rare superpower: it lets your money grow tax‑free—not tax‑deferred. When you combine it with diversified, low‑fee dividend ETFs, you create a simple, repeatable system to build wealth from both price appreciation and reinvested cash distributions, without the tax drag that can quietly erode returns in a taxable account. In short, if you want reliable income today and compounding tomorrow, the best dividend ETFs for TFSA in 2025 are an efficient, beginner‑friendly starting point.

Why now? The 2025 backdrop still features moderate rates, inflation risks, and sector rotation. Dividend ETFs provide built‑in diversification across Canadian financials, energy, utilities, telecom, and industrials—while keeping Management Expense Ratios (MER) low and distributions predictable (monthly or quarterly). Inside a TFSA, those cashflows can be automatically reinvested (DRIP) into more ETF units—creating a virtuous cycle of tax‑free compounding.

What you’ll gain from this guide

- How to choose TFSA‑friendly dividend ETFs (yield, MER, AUM, payout cadence, quality screens).

- Simple model portfolios you can copy and adapt.

- Step‑by‑step purchase flow with limit orders, DRIP, and annual rebalancing.

- Common pitfalls (yield traps, concentration risk, over‑contribution) and how to avoid them.

Who this is (and isn’t) for

- Great fit: Long‑term savers seeking tax‑free income + growth with low effort.

- Consider alternatives: If you need ultra‑high short‑term yield, speculate on single stocks, or require guaranteed principal—dividend ETFs may not match those goals.

Quick glossary (you’ll see these terms a lot)

- Yield: Cash distributions over the last year ÷ current price (changes with markets).

- MER: Management Expense Ratio—the annual fee embedded in the fund. Lower is usually better.

- Distribution frequency: How often you get paid (monthly/quarterly).

- DRIP: Dividend Re‑Investment Plan—your broker uses payouts to buy more ETF units automatically.

- AUM: Assets Under Management—larger funds often have tighter bid‑ask spreads and better liquidity.

A simple, TFSA‑friendly compounding example

Suppose you contribute $300/month into a dividend ETF with a 4.0% yield and a 0.22% MER, and you enable DRIP. Your net yield after fees is roughly ~3.78% (4.00% − 0.22% MER, simplified). Those cash distributions keep buying new units every month—so next month you earn dividends on a slightly larger base. Over years, that snowballing effect can rival headline performance even if markets are flat for stretches.

This is an illustration, not a promise. Actual returns vary with market prices, distribution policies, taxes on foreign income, and trading costs. Always verify current data on the fund’s factsheet.

Model your plan (Free DCA Calculator)

See how monthly TFSA deposits + DRIP may compound over time.

Premium DCA Calculator

Auto‑rebalancing, multi‑portfolio, and time‑machine views.

Investment Simulator

Back‑test ETF mixes and contribution schedules.

Myths vs. facts

- Myth: “Highest yield = best.” Fact: Very high yields can signal risk. Check payout ratios and balance‑sheet quality.

- Myth: “Quarterly payers are worse than monthly.” Fact: Cadence matters less than total return, fees, and sustainability—DRIP helps either way.

- Myth: “TFSA means no taxes anywhere.” Fact: TFSA protects you from Canadian tax; some foreign withholding may still apply on non‑Canadian dividends.

Always confirm your personal TFSA contribution room in CRA “My Account” to avoid penalties. If in doubt about foreign withholding or asset location (TFSA vs. RRSP vs. taxable), review our FAQ and your broker’s documentation.

TFSA Benefits for Dividend ETF Investors

1) Why a TFSA supercharges dividend ETFs

- Tax‑Free Growth: Dividends and capital gains earned inside a TFSA are not taxed—and remain tax‑free when you withdraw them. This is ideal for investors using the best dividend ETFs for TFSA who want income today and compounding tomorrow.

- No impact on benefits: TFSA withdrawals are not counted as taxable income, so they don’t reduce income‑tested benefits and credits.

- Low‑maintenance compounding: Pair monthly contributions with a Dividend Reinvestment Plan (DRIP) so cash distributions automatically buy more ETF units without commissions.

- Behavioral edge: A separate TFSA “bucket” helps ring‑fence long‑term investments from day‑to‑day spending.

2) Flexible withdrawals (with one key rule)

- Anytime, for any reason: Withdraw TFSA funds whenever you need—no taxes and no penalties.

- Room recontribution rule: Amounts you withdraw are added back to your contribution room next calendar year. If you re‑contribute in the same year without available room, you can incur penalties.

- Tip: If you must move money out late in the year (e.g., December), consider waiting until January to re‑contribute to avoid accidental over‑contributions.

3) Contribution room—how it actually works

- Annual limits accumulate: If you were eligible in past years but never contributed, your cumulative room may be large by 2025. Confirm exact room in CRA “My Account”.

- Carry‑forward forever: Unused room rolls over indefinitely; you don’t “lose” it at year‑end.

- Transfers: Moving investments between TFSAs at different institutions doesn’t use room if you file a direct transfer (ask your broker). Withdrawing and re‑depositing is not the same as a transfer and can cause over‑contributions.

4) What you can hold in a TFSA

- Qualified investments: Most exchange‑traded funds (ETFs), stocks, bonds, GICs, and cash are eligible.

- Foreign income nuance: The TFSA protects you from Canadian tax; some foreign withholding tax may still apply to non‑Canadian dividends. Many investors prioritize Canadian dividend ETFs inside TFSA and consider account placement for U.S. income separately.

5) TFSA vs. RRSP—quick matrix for dividend investors

| Feature | TFSA | RRSP |

|---|---|---|

| Tax on growth/withdrawals | Tax‑free growth & withdrawals | Tax‑deferred growth; withdrawals taxed as income |

| Best for | Long‑term, flexible income + growth (e.g., best dividend ETFs for TFSA) | High earners now, lower tax bracket later |

| Foreign dividends | May face foreign withholding | Treaty benefits may reduce U.S. withholding |

| Withdrawal flexibility | Anytime; room restored next year | Restricted; withdrawals are taxable (exceptions apply) |

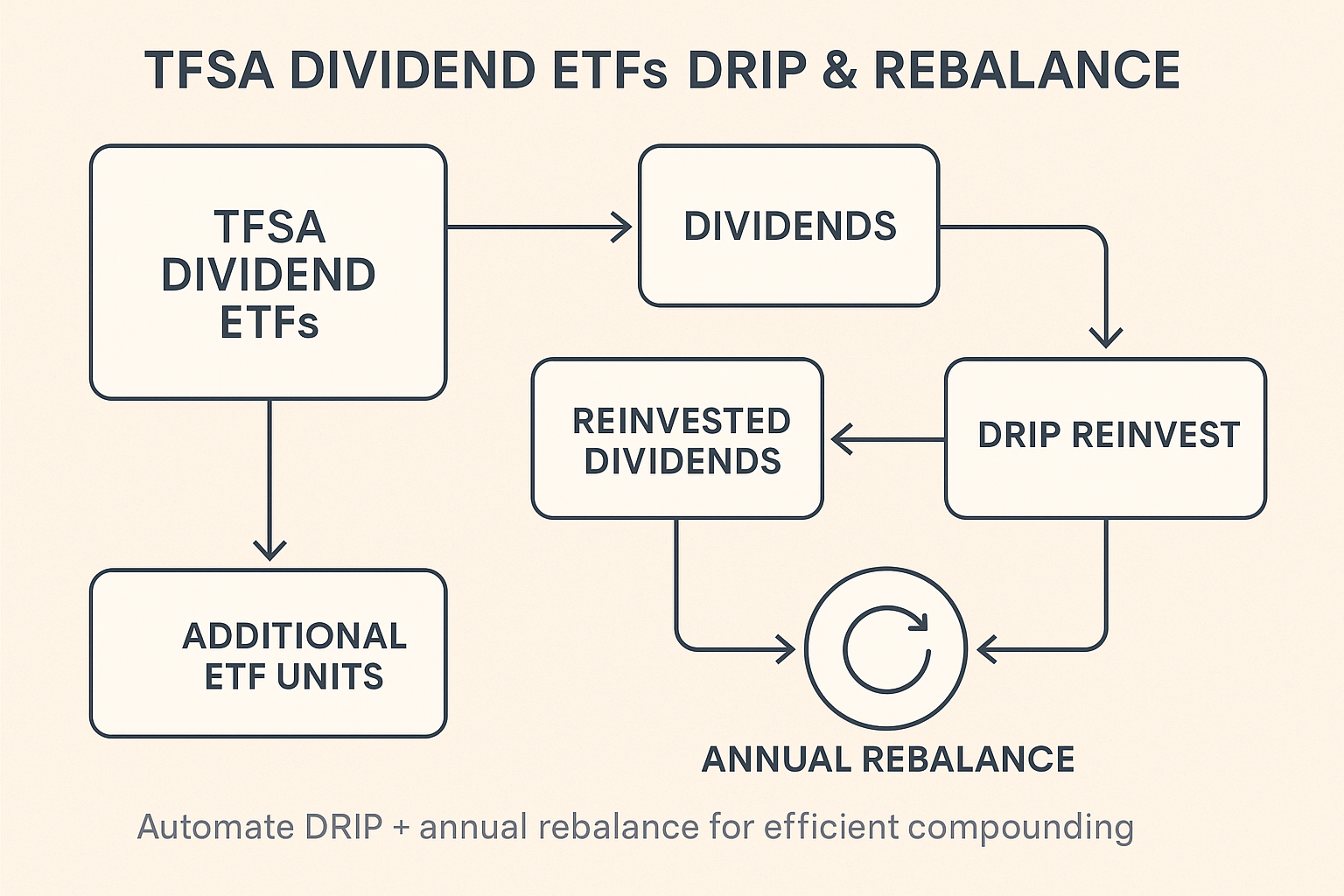

6) Automation playbook (set‑and‑forget)

- Auto‑deposit: Schedule bi‑weekly or monthly TFSA contributions aligned with payday.

- Buy list: Pre‑choose 1–3 TFSA dividend ETFs and use limit orders during liquid hours (10am–3pm ET).

- Enable DRIP: Reinvest distributions into more ETF units automatically.

- Annual rebalance: Nudge positions back to target weights (or use cash flows to “rebalance by buying”).

7) Pitfalls & edge cases to avoid

- Yield traps: An unusually high yield can hint at risk; check payout ratios and balance‑sheet health.

- Over‑contribution: Track deposits carefully, especially if you use multiple brokers or transfer accounts.

- Sector concentration: Canadian high‑dividend ETFs often tilt to Financials/Energy—diversify across funds if needed.

- Withdrawal timing: Re‑contribute the following year unless you still have room available this year.

Note: Always verify current TFSA rules and your personal contribution room in CRA “My Account” to avoid penalties. If you’re unsure how to place U.S. dividend exposure across TFSA/RRSP/taxable, review our FAQ and your broker’s guidance.

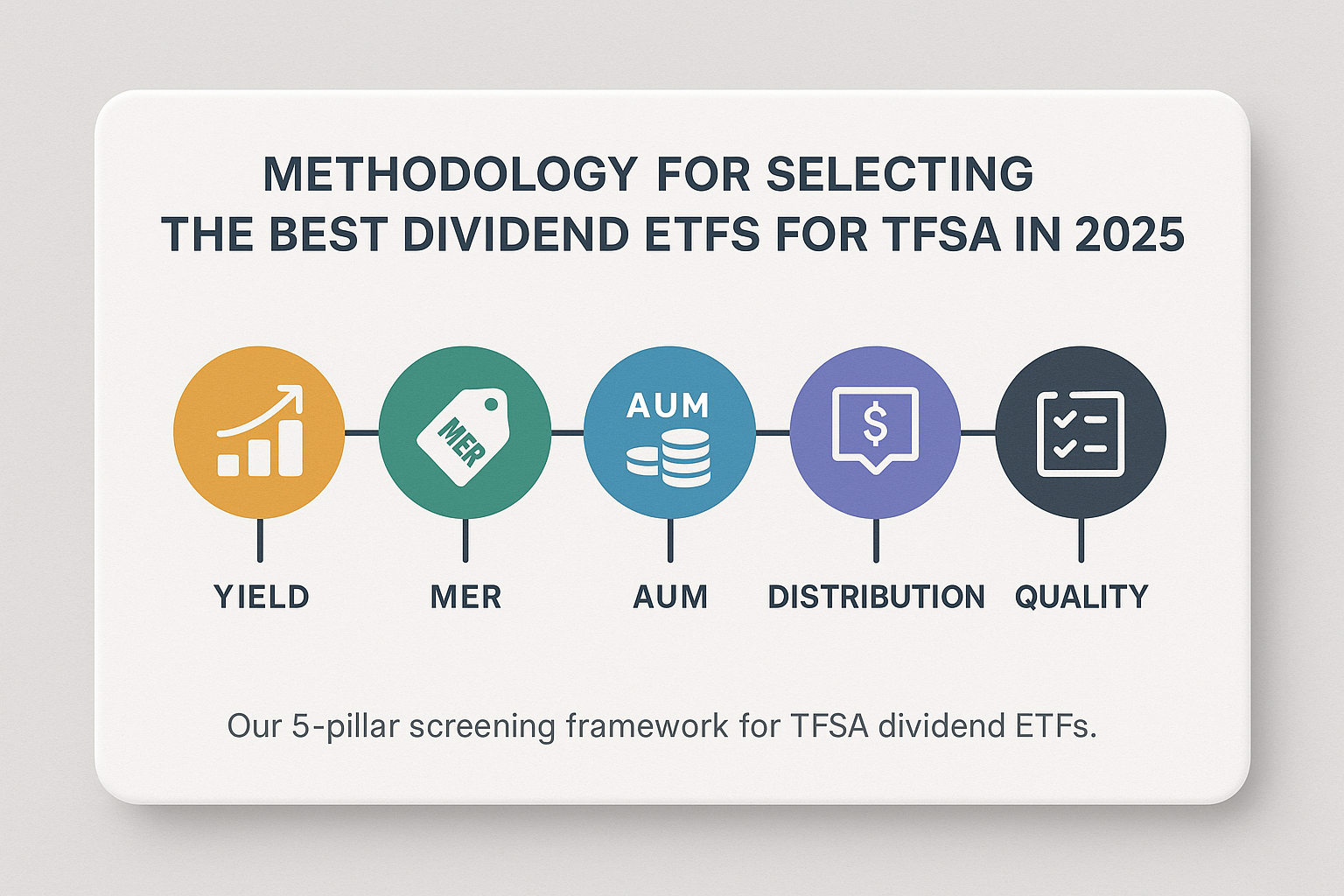

How We Selected the Best Dividend ETFs for TFSA in 2025

Picking the right ETFs for your TFSA is more than just chasing the highest yield. Our team applied a five-pillar screening framework designed to balance attractive income, low cost, and long-term stability — while avoiding “yield traps” and overly concentrated portfolios. Here’s how we broke it down:

- Sustainable Yield (Target: 3.5%–5.0% trailing) Funds had to deliver a competitive yield without signaling excessive risk. For example, a 9% yield may look tempting but could indicate an imminent dividend cut or an over-reliance on a single volatile sector. We cross-checked payout ratios, sector exposure, and dividend-growth history to filter out unstable payers.

- Low Fees (MER ≤ 0.30%) Management Expense Ratio (MER) directly reduces your net yield. In a TFSA, where your gains and income are tax-free, keeping costs low maximizes compounding. We prioritized ETFs with MERs under 0.30%, with some standout core options charging as little as 0.22%.

- Size & Liquidity (AUM ≥ $200M CAD) Larger ETFs tend to have tighter bid-ask spreads and greater daily trading volume, reducing hidden transaction costs. We excluded tiny niche funds that may be harder to trade without price slippage, especially for buy-and-hold investors automating monthly TFSA contributions.

- Distribution Cadence (Monthly or Quarterly) Consistent payouts help with cash-flow planning. While monthly distributions (e.g., ZDV) are popular for budgeting, quarterly payouts work well for DRIP strategies where cash is automatically reinvested. We included both styles in our final picks.

- Quality Screens Beyond yield, we favoured ETFs using quality filters — such as minimum dividend-growth streaks, return-on-equity requirements, or balance-sheet health metrics. This helps reduce the risk of owning companies that maintain high yields by eroding capital or taking on excessive debt.

This process narrowed the universe to a shortlist of diversified, low-cost, and TFSA-friendly ETFs capable of delivering tax-free income and long-term growth. Reminder: ETF metrics change over time — always check the latest factsheets from providers before placing orders.

Pro Tip

Use our Free DCA Calculator to model how different yields, MERs, and payout frequencies could affect your TFSA balance over 10–20 years. You’ll see how even a 0.1% fee difference can compound into thousands of extra dollars.

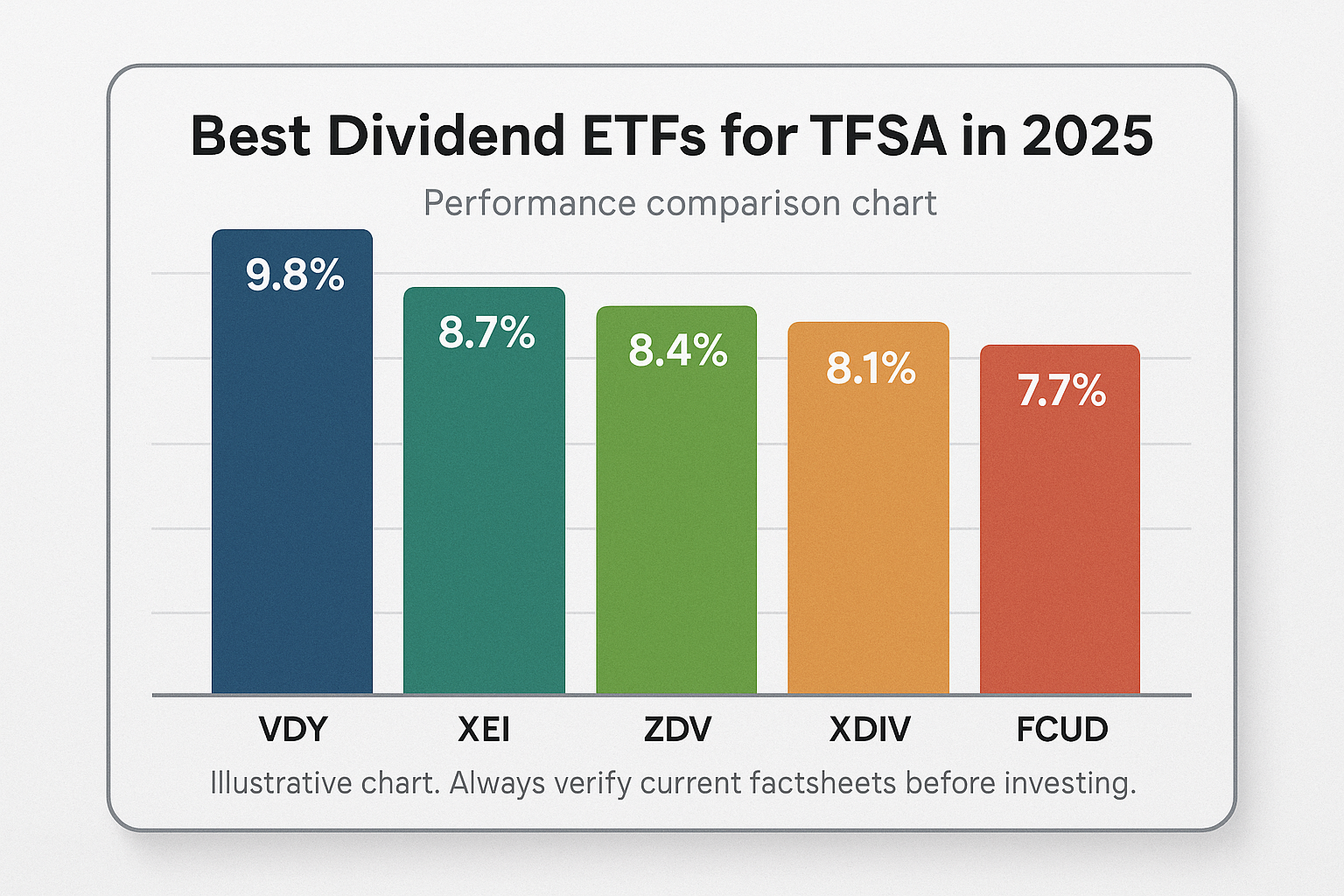

Top Picks: The Best Dividend ETFs for TFSA in 2025

Based on our 5-pillar screening framework, these five ETFs stand out for their balance of yield, fees, quality, and TFSA suitability. Each offers a slightly different approach — from pure high yield to dividend growth or quality screens — so you can mix and match depending on your goals.

Vanguard Canadian High Dividend Yield Index ETF (VDY)

Low MER • Broad Canadian high-dividend exposure • Quarterly distributions

Tracks the FTSE Canada High Dividend Yield Index, focusing on ~40–75 of the highest-yielding Canadian stocks, with a tilt toward financials and energy.

- Use case: Core high-yield Canadian equity holding for steady TFSA income.

- What to watch: Heavy concentration in banks and pipelines may amplify sector swings.

- Why TFSA-friendly: Low MER (0.22%) plus tax-free compounding of quarterly payouts.

✅ Pros

- Ultra-low fee for a dividend fund

- Strong liquidity and large AUM

- DRIP-friendly for compounding

⚠️ Cons

- Sector concentration risk

- Yield can fluctuate with oil & bank cycles

iShares Core S&P/TSX Composite High Dividend ETF (XEI)

Low MER • Broad high-dividend Canadian large caps • Quarterly distributions

Holds ~70 Canadian large-cap stocks with above-average yields, offering diversified sector exposure at a low cost (MER 0.22%).

- Use case: Diversified high-yield exposure with a balanced sector mix.

- What to watch: Yield slightly lower than more concentrated peers.

- Why TFSA-friendly: Broad diversification reduces single-sector shocks.

✅ Pros

- Broad sector exposure

- Low MER for a dividend ETF

- Good DRIP compatibility

⚠️ Cons

- Lower yield than pure high-dividend plays

- Quarterly distributions only

iShares Canadian Dividend Aristocrats ETF (CDZ)

Dividend growth screen • Blue-chip tilt • Quarterly distributions

Focuses on companies with at least 5 consecutive years of dividend increases, blending yield with growth potential.

- Use case: For TFSA investors who want dividend stability and growth over time.

- What to watch: Higher MER (0.66%) than core funds.

- Why TFSA-friendly: Dividend growth compounds tax-free, boosting future income streams.

✅ Pros

- Focus on reliable dividend growers

- Lower volatility than high-yield peers

⚠️ Cons

- Highest MER on this list

- Yield slightly below high-yield ETFs

BMO Canadian Dividend ETF (ZDV)

Monthly distributions • Stability tilt

Combines high-yield Canadian equities with a stability screen, offering consistent monthly cash flow.

- Use case: Ideal for investors who value predictable monthly payouts.

- What to watch: Smaller AUM than giants like VDY/XEI.

- Why TFSA-friendly: Monthly DRIP creates more frequent compounding opportunities.

✅ Pros

- Monthly income stream

- Stability screen reduces riskier picks

⚠️ Cons

- MER slightly higher than the cheapest options

- May underperform in strong bull markets

Invesco Canadian Dividend Index ETF (PDC)

Quality + yield screen • Quarterly distributions

Screens for high yield plus quality metrics like payout ratio, ROE, and balance sheet strength.

- Use case: High yield seekers who also want safeguards against unsustainable payouts.

- What to watch: MER higher than the cheapest high-yield ETFs.

- Why TFSA-friendly: Quality screen helps protect principal while compounding dividends tax-free.

✅ Pros

- High yield with quality checks

- Broad sector representation

⚠️ Cons

- MER not the lowest

- Quarterly payouts only

| ETF | Focus | Fee (MER) | Payout | Notes |

|---|---|---|---|---|

| VDY | Canadian high dividend | 0.22% | Quarterly | Low-cost core income ETF |

| XEI | Broad high-dividend large caps | 0.22% | Quarterly | Diversified, DRIP-friendly |

| CDZ | Dividend growth "Aristocrats" | 0.66% | Quarterly | Focus on dividend growers |

| ZDV | High dividend, monthly cash | 0.39% | Monthly | Monthly income + stability |

| PDC | Quality + yield | 0.55% | Quarterly | Quality screen for sustainability |

Always verify latest MERs, yields, and holdings on provider sites (Vanguard, iShares, BMO, Invesco) or Morningstar before buying.

How to Build a Balanced TFSA Dividend ETF Portfolio

Building a TFSA dividend ETF portfolio is about aligning your income needs, risk tolerance, and growth expectations. The following model allocations are purely illustrative — they are meant to guide your thinking, not replace your own due diligence.

Sample Allocations (Illustrative)

💰 Income Focused:

40% VDY • 30% XEI • 20% ZDV • 10% PDC

- Best for retirees or income-seekers wanting higher cash flow now.

- ZDV’s monthly payouts smooth income, while VDY and XEI boost yield with broad Canadian exposure.

- PDC adds a quality screen to reduce the risk of dividend cuts.

📈 Dividend Growth:

35% CDZ • 30% VDY • 25% XEI • 10% PDC

- For long-term investors prioritizing steady dividend increases over maximum current yield.

- CDZ’s dividend-growth tilt can provide inflation protection over time.

- VDY and XEI keep the yield respectable while adding sector diversification.

🔹 Simple Core:

60% VDY • 40% XEI

- Ideal for beginners who want a low-maintenance TFSA portfolio.

- Only two ETFs, both low-cost, highly liquid, and DRIP-friendly.

📌 Tip: Rebalance annually, or when any holding drifts more than 5–10% from its target weight. Enabling DRIP (Dividend Reinvestment Plan) allows you to automatically reinvest distributions, compounding growth tax-free.

You can simulate these allocations with our Free Investment Simulator, or unlock automated portfolio tracking and annual rebalancing with the Premium DCA Calculator.

Step-by-Step: How to Invest in the Best Dividend ETFs for Your TFSA (2025)

- Open a TFSA with a low-fee online broker such as Wealthsimple, Questrade, or Interactive Brokers (IBKR). Look for commission-free ETF trades and no account maintenance fees.

- Fund the Account via EFT or in-kind TFSA transfer from another institution. Always confirm your contribution room in CRA “My Account” to avoid the 1%/month over-contribution penalty.

- Choose Your Dividend ETFs based on your income vs. growth priorities. Use our Top Picks list as a starting point.

- Place Limit Orders during peak liquidity hours (10am–3pm ET) to reduce bid-ask spreads and execution slippage.

- Enable DRIP (Dividend Reinvestment Plan) for each ETF so distributions automatically buy more units without commission.

- Automate Contributions on a weekly, bi-weekly, or monthly schedule to apply dollar-cost averaging (DCA) and smooth out market volatility.

- Rebalance Annually or when a holding drifts more than 5–10% from your target allocation. This maintains your intended risk/reward profile without excessive trading.

📌 Pro tip: Model your contributions, cost basis, and potential income using our Free DCA Calculator, or unlock auto-rebalancing and portfolio tracking with the Premium DCA Calculator.

Tax Note: Holding U.S. Dividend ETFs Inside a TFSA

While a Tax-Free Savings Account (TFSA) shields you from Canadian tax on investment growth, it does not eliminate the 15% U.S. withholding tax on dividends from American companies. This applies whether you hold U.S. stocks directly or through a U.S.-listed ETF.

Because the TFSA is not recognized under the Canada-U.S. tax treaty, the withholding is unavoidable. Many Canadian investors therefore:

- Hold Canadian dividend ETFs in their TFSA to maximize truly tax-free income.

- Use an RRSP for U.S. dividend ETFs, where the treaty often eliminates withholding tax.

- Reserve taxable accounts for U.S. growth ETFs with low or no dividends.

✅ Tip: Check CRA’s TFSA guide and your broker’s tax documentation before buying U.S. income funds in a TFSA. Learn more about portfolio placement strategies to improve after-tax returns.

Risks & Pitfalls of TFSA Dividend ETFs

- Yield Traps: Beware of unusually high dividend yields — they may signal unsustainable payouts. Always review payout ratios and free cash flow trends.

- Sector Concentration: The Canadian market is heavily weighted to Financials and Energy. Consider holding multiple ETFs to spread risk.

- Fee Creep: Even a 0.2% higher MER compounds over time. Favor low-cost core holdings for long-term compounding.

- Over-Contribution Penalties: Exceeding your TFSA limit triggers a 1% monthly penalty. Confirm your room on CRA’s “My Account”.

- Currency & Withholding Tax: U.S. income inside a TFSA may face 15% withholding tax. Learn the best account type for U.S. dividend ETFs.

💡 Pro tip: Before you invest, run your portfolio through our Free Investment Simulator to see how fees and allocation impact long-term returns.

Helpful Tools & Further Reading

- Free DCA Calculator — model recurring contributions and reinvested dividends.

- Premium DCA Calculator — advanced rebalancing, multi‑portfolio, and time‑machine views.

- Investment Simulator — test ETF blends and contribution schedules.

- Lump Sum vs. DCA — when each approach wins historically.

- WhatIfBudget — free no‑login budgeting tool to align cash flow with investing.

- All Blog Posts — ETF, investing, crypto, and strategy deep dives.

- CRA: TFSA Guide — official rules on limits, withdrawals, and penalties.

Bottom Line: Pick Low Fees, Sustainable Yields, and Automate

The best dividend ETFs for TFSA in 2025 share three traits: reasonable yields, low MERs, and consistent distributions. Use DRIP to reinvest, automate contributions for DCA, and rebalance annually. Small, disciplined decisions compound tax‑free — that’s the core TFSA advantage.

Next step

Plan your exact contribution schedule and income path with the Premium DCA Calculator. See how monthly deposits and DRIP can accelerate your TFSA’s dividend growth.

Disclosure: This article is for education only, not investment advice. Always verify fund details and consider speaking with a licensed advisor.

FAQ — Best Dividend ETFs for TFSA in 2025

What is the best dividend ETF for a TFSA in 2025?

There’s no single “best” fund for everyone. Many Canadians pair a low‑fee core high‑dividend ETF (e.g., VDY or XEI) with a dividend‑growth or quality screen (e.g., CDZ or PDC) and, if desired, a monthly payer like ZDV.

Should I choose monthly or quarterly distributions?

Monthly payouts (e.g., ZDV) help with budgeting. Quarterly is fine if you DRIP and don’t need monthly cash flow. Focus more on fee, quality, and sustainability than cadence alone.

Is DRIP worth enabling inside a TFSA?

Yes. DRIP automatically reinvests distributions without commissions, compounding tax‑free. It’s a set‑and‑forget boost to long‑term returns.

Can I hold U.S. dividend ETFs in a TFSA?

You can, but U.S. withholding may apply to dividends even inside a TFSA. Some investors place U.S. dividend funds in RRSP instead and keep Canadian dividend ETFs in TFSA.

How much should I allocate to dividend ETFs vs. growth ETFs?

It depends on your goals and risk tolerance. Income‑focused investors might hold 60–80% dividend ETFs; growth‑oriented investors might tilt lower (30–50%) and complement with broad market growth funds.