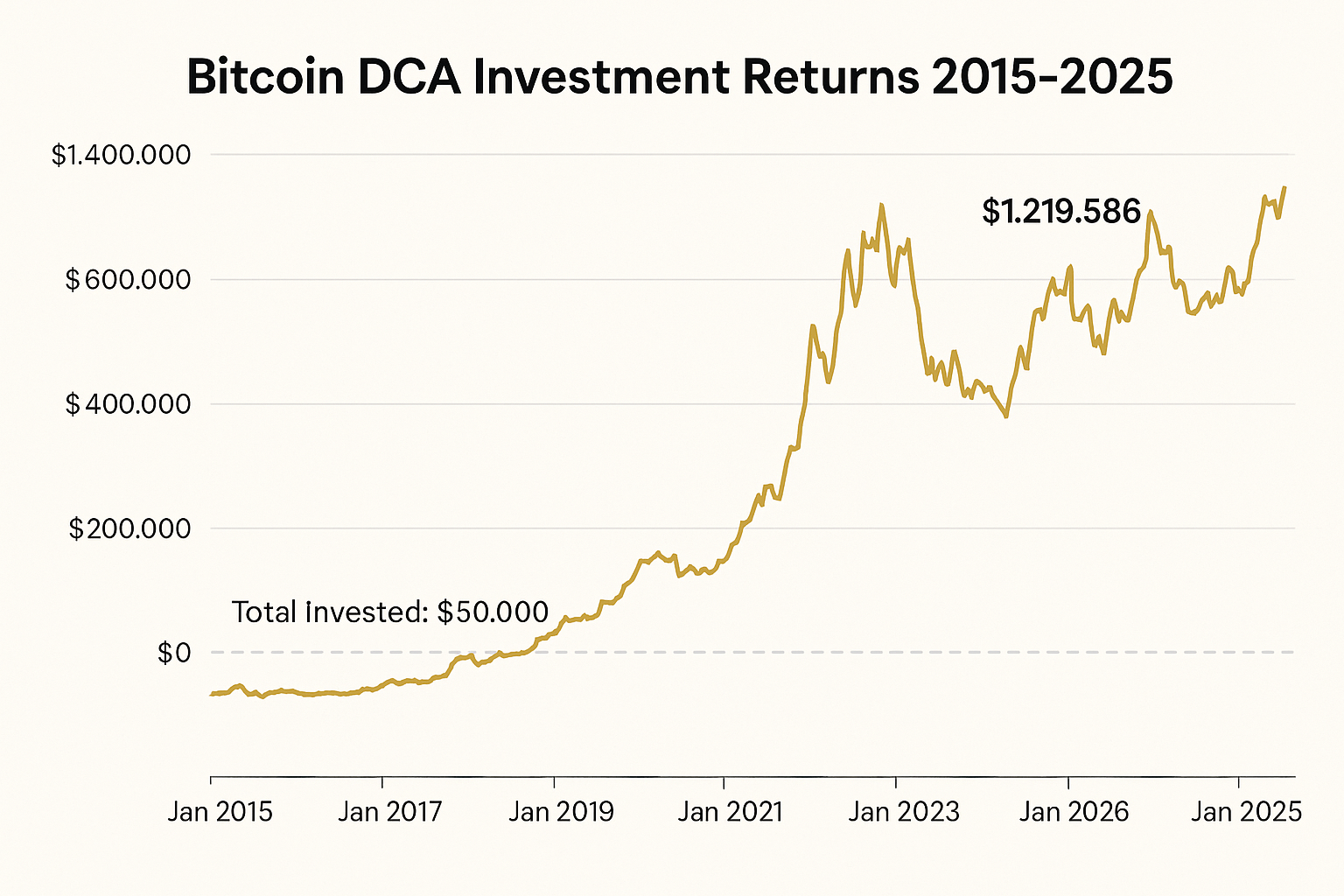

What If You Invested $100 in Bitcoin Every Month Since 2015? (DCA ROI) 💰

Ever wondered how much $100 a month into Bitcoin could have grown since 2015? In this guide, we break down a decade of results using a simple

Dollar‑Cost Averaging (DCA) approach, compare it with a lump sum, show an ROI table by period (2015–2017, 2018–2020, 2021–2025), and share practical tips, risks, and tax notes for US/Canada.

On this page

Why 2015 matters for Bitcoin

In 2015, Bitcoin transitioned from an early, experimental asset into a candidate for mainstream attention. Price consolidated broadly in the $200–$400 range, infrastructure matured (better exchanges, wallets, custody), and the investment narrative shifted from purely speculative to long‑term scarcity and adoption. Starting a DCA then meant accumulating steadily before multiple adoption waves and halving cycles.

Key structural drivers (2015–2025)

- Periodic halvings reducing new BTC issuance

- Institutional infrastructure: custody, derivatives, data

- Growing retail access (fintechs, exchanges, later ETFs)

- Macro episodes (liquidity cycles, inflation concerns)

Bitcoin DCA since 2015: simulation setup

- Strategy: invest $100 at the start of every month

- Period: January 2015 → April 2025 (you can extend in the simulator)

- Data: historical monthly prices (e.g., CoinGecko)

- Assumptions: no taxes/fees, monthly buys at open (simplification)

- Goal: illustrate the long‑term effect of consistency and volatility smoothing

Methodology note: Real results depend on exact timestamps, fees, slippage, and taxes. Re‑run your scenario with our interactive tools for precise numbers.

Results: What if you invested $100 in Bitcoin every month since 2015?

Below is a high‑level view of how a simple Bitcoin DCA could have evolved across three distinct market regimes. Values are indicative and rounded; use the simulator to recompute with your preferred dates and fees.

| Period | Total Invested | Indicative Ending Value* | Approx. ROI | What happened |

|---|---|---|---|---|

| 2015–2017 | $3,600 | $30,000 – $90,000 | ~8× – 25× | Consolidation → first major bull run (2017) |

| 2018–2020 | $3,600 | $6,000 – $25,000 | ~1.7× – 7× | Bear market → accumulation → 2020 halving |

| 2021–2025 | $5,200+ | $20,000 – $120,000+ | ~4× – 23× | New highs, drawdowns, recovery & renewed adoption |

*Ranges are illustrative, rounded, and depend on exact dates/prices/fees. Recalculate precisely with our tools.

Test your own scenario in minutes

Run the same Bitcoin DCA since 2015, tweak amounts, add multiple assets, or compare lump sum vs DCA with our tools:

Bitcoin DCA vs lump sum: which wins?

Lump sum historically outperforms in rising markets because more capital is exposed earlier. However, DCA excels at behavioral risk management: it reduces regret, avoids timing stress, and keeps you investing through volatility. For most investors, the best strategy is the one you can follow consistently for years.

- Lump sum pros: maximum exposure in bull runs; fewer transactions.

- Lump sum cons: nasty drawdowns if you buy before a crash.

- DCA pros: smooths entry price; automates discipline; easier psychologically.

- DCA cons: may underperform lump sum in a steadily rising market.

Why Dollar‑Cost Averaging works for volatile assets like crypto

Volatility cuts both ways. With DCA, you buy more when prices fall and less when prices rise, pulling your average cost toward a reasonable long‑term level without guessing tops/bottoms. It also reduces decision fatigue—crucial in crypto’s 24/7 markets.

Reminder: DCA is a discipline, not a guarantee of profits. Diversification, risk sizing, and a long horizon matter.

Risks and how to manage them

1) Big drawdowns and high volatility

Even high‑conviction assets can drop 50–80% in a cycle. Use position sizing you can hold through brutal drawdowns.

2) Platform and custody risk

Prefer reputable brokers/exchanges; consider hardware wallets for long‑term holdings. Enable 2FA, secure backups, and phishing awareness.

3) Behavioral errors

Over‑trading, chasing pumps, panic selling. Automate DCA to reduce emotion and review quarterly, not daily.

4) Regulatory and tax changes

Rules evolve. Track cost basis, holding periods, and reporting requirements (see below).

Bitcoin taxes: quick notes (US & Canada)

United States (high level)

- Crypto sales are typically subject to capital gains tax.

- Short‑term vs long‑term rates depend on holding period.

- Keep records: dates, amounts, cost basis, proceeds, fees.

Canada (high level)

- Capital gains apply; generally 50% inclusion rate of net gains.

- Crypto used for goods/services may trigger taxable events.

- Maintain detailed logs for CRA reporting.

This is educational, not tax advice. Consult a professional for your situation.

Outlook: what could happen next?

Past performance doesn’t guarantee future returns. Still, the combination of supply constraints, broader access (including ETFs in some regions), and maturing infrastructure suggests Bitcoin will keep cycling through expansions and contractions. A rules‑based plan (e.g., monthly DCA + periodic rebalancing) can help you participate without guessing tops and bottoms.

Ready to run your own plan?

Build a custom DCA or lump sum strategy, add multiple portfolios, enable auto‑rebalancing, and visualize your progress over time.

FAQ — Bitcoin DCA since 2015

Is it too late to start a Bitcoin DCA?

No one can predict future prices, but a small, disciplined DCA can help you participate without timing the market. Focus on consistency and risk control.

Does DCA always beat lump sum?

No. Lump sum can outperform in steadily rising markets. DCA shines at reducing timing risk and behavioral mistakes.

How much should I allocate to Bitcoin?

Depends on your risk tolerance and time horizon. Many investors cap high‑volatility assets as a percentage of their portfolio and rebalance periodically.

Which day of the month is best to buy?

Over long periods, the exact day matters far less than sticking to your plan. Pick a day you can automate and keep it simple.

What about fees and taxes?

Fees reduce returns; pick efficient platforms. Keep accurate records for tax reporting and consult a professional where needed.