🏖️ How to Simulate a Retirement Plan with DCA

A complete guide to planning your retirement using retirement DCA simulation techniques.

Planning for retirement can feel overwhelming. Markets are volatile, salaries fluctuate, and it’s hard to know whether your savings will be enough. One of the most effective strategies to reduce risk while building wealth is dollar-cost averaging (DCA). By investing a fixed amount regularly, you smooth out market volatility and steadily grow your retirement portfolio.

But here’s the challenge: how do you know if your DCA contributions will actually meet your retirement goals? That’s where a retirement DCA simulation comes in. By modeling your savings and investments, you can estimate potential outcomes, test different scenarios, and adjust your plan early.

📘 Step 1: Understanding DCA for Retirement

Dollar-Cost Averaging (DCA) is an investing strategy where you invest a fixed amount of money at regular intervals—monthly, bi-weekly, or quarterly—no matter what the market is doing. Instead of stressing about buying at the “perfect” time, you spread your risk over decades. This is particularly powerful for retirement investing, where the time horizon is usually 20 to 40 years.

For example, let’s say you invest $500 per month in a retirement account tracking the S&P 500. Over 30 years, assuming a 7% average annual return, your portfolio could grow to over $600,000. That’s without ever needing to predict when markets will rise or fall. By sticking to a long-term DCA strategy, you benefit from both market growth and compounding.

This approach works because:

- You buy more shares when markets are down, fewer when markets are up—reducing your average cost.

- It reduces emotional decision-making and keeps you consistent.

- It’s simple and scalable: you can start with as little as $50/month and increase over time.

For retirement planning, DCA is not just convenient—it’s essential. A retirement DCA simulation shows you how different contribution levels can affect your end goal, helping you find the right balance between affordability today and financial security tomorrow.

👉 If you’re new to DCA, check out our article Best Dollar-Cost Averaging Strategies Explained for a deeper dive into the mechanics.

🔍 Step 2: Why Simulation Matters

Knowing that DCA works is not enough. Every retirement plan depends on multiple variables: your contribution amount, the length of time until retirement, market returns, inflation, and even fees. A retirement simulation with DCA allows you to see how these factors interact, giving you a realistic projection of your financial future.

For example, investing $300 per month for 30 years at 6% average returns would leave you with roughly $300,000. But if you increase contributions to $400 per month—or if markets average 7%—your ending balance could exceed $500,000. These differences are massive, and only a simulation can highlight them in advance.

A DCA retirement calculator can help you answer questions like:

- How much will my portfolio be worth by age 65?

- What happens if markets underperform for a decade?

- How much should I increase contributions each year to beat inflation?

- What’s the impact of fees or taxes on my long-term results?

Simulation also prepares you psychologically. Instead of panicking during a bear market, you’ll know in advance that your long-term plan is resilient. That confidence is invaluable—it helps you stick to your plan when others quit.

In short, retirement DCA simulation transforms abstract numbers into actionable insights. It gives you the clarity to adjust your plan early, so you don’t discover shortfalls when it’s too late.

🖥️ Step 3: Tools for Retirement DCA Simulation

Running a retirement planning simulation doesn’t require complex spreadsheets anymore. Today, free and premium tools make it easy to visualize your financial future with just a few clicks. The right tool can compare lump sum vs DCA, project portfolio growth, and even adjust for inflation.

Here are some of the most effective tools:

- Investment Simulator – Backtest lump sum vs DCA strategies with real historical data.

- Free DCA Calculator – Quickly model monthly contributions, growth rates, and outcomes.

- Premium DCA Simulator – Unlock advanced features like multi-portfolio testing, auto-rebalancing, and detailed retirement-focused projections.

If you prefer spreadsheets, Google Sheets or Excel can also serve as DIY simulators. However, dedicated online tools are faster and include built-in visualizations. For example, the WhatIfBudget tool can connect your spending habits with your investment goals, helping you free up more money for retirement contributions.

👉 External resource: For more on the psychology of retirement investing, see Investopedia’s guide on Dollar-Cost Averaging.

⚙️ Step 4: Building Your Retirement DCA Simulation

Now that you know the basics of dollar-cost averaging, it’s time to build a retirement DCA simulation that fits your personal situation. The process is simple, but it requires clarity on three main variables: your time horizon, your contribution amount, and your expected rate of return.

1. Define your retirement horizon

Start by identifying how many years you have until retirement. For example, a 30-year-old with plans to retire at 65 has a 35-year horizon. Longer horizons mean more compounding and a greater benefit from DCA. Even small monthly contributions can grow into six or seven figures over decades.

2. Set your monthly contribution

Next, decide how much you can realistically invest every month. A budgeting tool helps identify how much disposable income you can allocate. Even $200/month can grow into a substantial nest egg when paired with consistent contributions and market growth.

3. Estimate your expected returns

This is where simulations shine. A typical assumption for stock market returns is 6–8% annually, but more conservative estimates (4–5%) account for volatility and inflation. By testing different growth rates, you’ll see a range of possible outcomes.

👉 Example: A 30-year-old investing $500/month for 35 years at 7% returns could end up with over $900,000. At 5%, the outcome drops closer to $600,000. That’s why running a DCA retirement calculator is essential—you get clarity on the risks and rewards.

| Monthly Contribution | Years | 5% Returns | 7% Returns |

|---|---|---|---|

| $300 | 30 | $250,000 | $340,000 |

| $500 | 35 | $600,000 | $900,000 |

By structuring your retirement DCA simulation this way, you can model optimistic, neutral, and conservative outcomes—giving you a realistic view of what to expect.

📊 Step 5: Case Studies & Scenarios

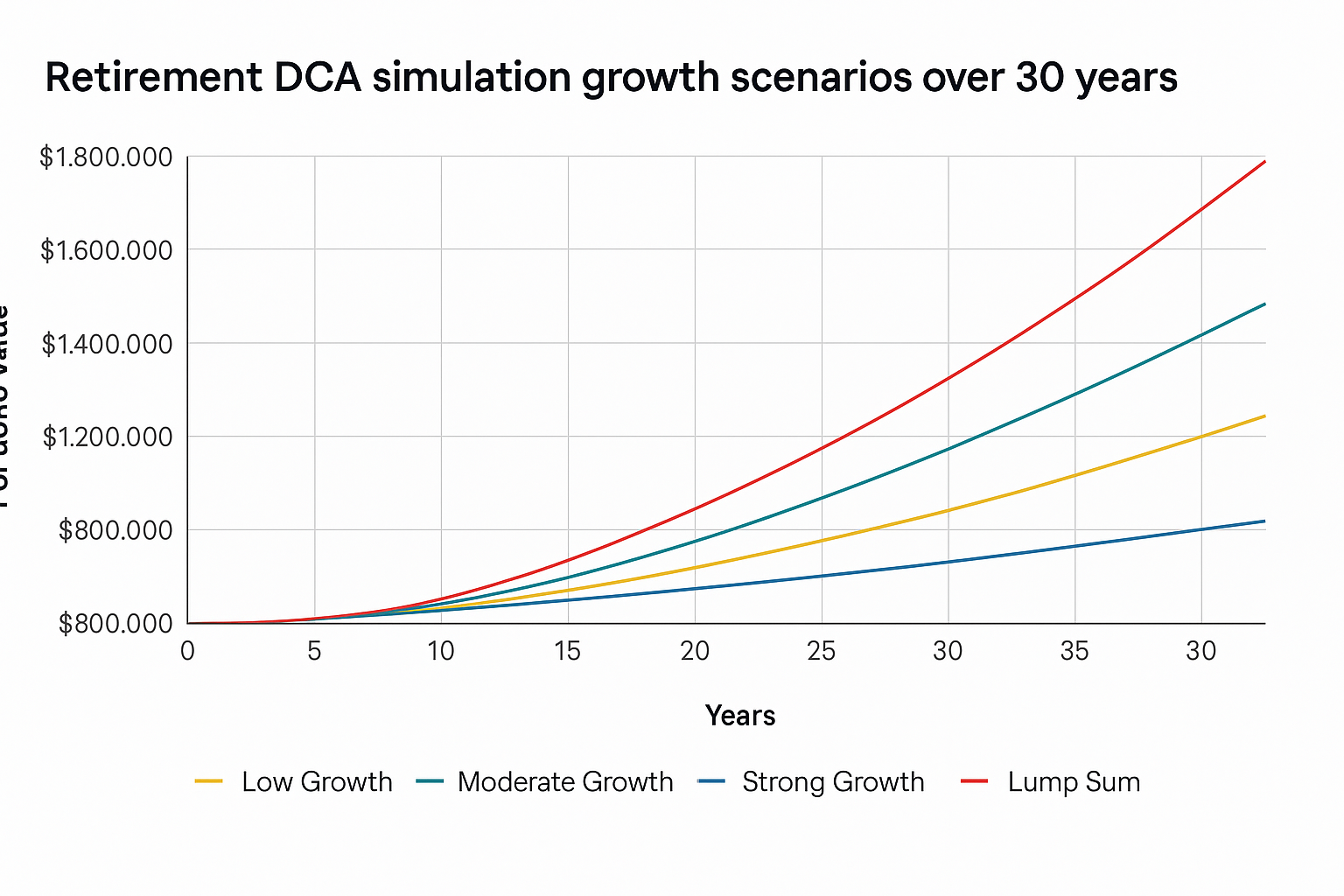

To understand how powerful a retirement DCA simulation can be, let’s walk through a few real-world scenarios. These case studies highlight different asset allocations and risk levels to show how results can vary.

Case 1: S&P 500 Index Fund (Conservative Growth)

A 25-year-old invests $400/month into an S&P 500 ETF for 40 years. Using historical data (average ~7% annual return), the ending balance could exceed $1,000,000. Even during major downturns like 2008, consistent DCA contributions would have bought more shares at lower prices, fueling long-term growth.

Case 2: Bitcoin Allocation (High Risk, High Reward)

Suppose an investor allocated 10% of their monthly contributions into Bitcoin from 2015 onward. Despite extreme volatility, the results could be staggering. Simulations show that $100/month into Bitcoin since 2015 could grow into hundreds of thousands by 2025. However, risk is much higher, which is why simulations are essential to test different allocations.

Case 3: Balanced Portfolio (60% Stocks, 40% Bonds)

A 40-year-old closer to retirement may prefer stability. Contributing $700/month to a 60/40 stock-bond portfolio could yield ~$650,000 over 25 years with reduced volatility compared to an all-stock portfolio. A retirement planning simulation can reveal whether the trade-off between growth and safety fits your personal goals.

👉 Want to explore your own scenarios? Use the WhatIfInvested Investment Simulator to compare your personal DCA contributions against lump sum investing. You can even test multiple portfolios side by side with our Premium DCA Simulator.

❌ Step 6: Common Mistakes & How to Avoid Them

While DCA is a powerful retirement strategy, many investors make mistakes that reduce its effectiveness. Running a DCA retirement calculator in advance can help you avoid these pitfalls:

1. Starting too late

The earlier you start, the more compounding works in your favor. Waiting until age 40 instead of 25 can mean hundreds of thousands less at retirement. Even if you can only invest $100/month, starting now is better than waiting.

2. Not adjusting contributions

Many investors set a fixed monthly amount and never increase it. But inflation erodes value over decades. Increasing contributions by just 2–3% annually keeps your plan aligned with rising costs.

3. Ignoring fees and taxes

High management fees can eat away at your returns. For example, a 1% fee may cost you over $200,000 on a $1M portfolio over 30 years. Choose low-cost index funds and use tax-advantaged accounts (TFSA, 401k, RRSP, IRA) whenever possible.

4. Investing only in one asset

Putting all contributions into a single stock or crypto asset is risky. Diversification across ETFs, bonds, and equities balances growth and safety. Our guide How to Create a Diversified DCA Portfolio explains how.

👉 External resource: See the Bogleheads Dollar-Cost Averaging Guide for a community-driven perspective on long-term investing discipline.

🚀 Step 7: Optimizing Your Retirement DCA Plan

Once you’ve built a retirement DCA simulation, the final step is optimization. DCA is powerful by itself, but fine-tuning your plan can significantly improve results and reduce risk. Think of it as moving from “basic driving” to “performance driving” with your retirement portfolio.

1. Adjust contributions as income grows

As your salary increases, your contributions should increase too. Even a 2% annual bump in contributions can result in hundreds of thousands more at retirement. Use tools like WhatIfBudget to plan gradual increases without straining your lifestyle.

2. Diversify across asset classes

Don’t rely on a single investment vehicle. While equities may drive growth, bonds provide stability, and alternatives like REITs or gold can hedge against inflation. A Lump Sum vs DCA retirement case study shows how diversification plays out in real simulations.

3. Automate your strategy

Automation removes human error. Setting up automatic transfers into your retirement accounts ensures you never miss a contribution. Most brokers and apps, including Wealthsimple, allow you to automate monthly DCA investments into ETFs, mutual funds, or stocks.

4. Monitor, but don’t overreact

Review your portfolio once or twice a year to ensure you’re on track, but avoid the temptation to panic-sell during downturns. Your DCA retirement calculator already accounts for volatility—sticking to your plan is usually the best strategy.

In summary, optimization means: increase contributions gradually, diversify, automate, and stay disciplined. A well-built retirement DCA simulation makes these adjustments easier by showing you their long-term impact before you implement them.

❓ Frequently Asked Questions

Is DCA the best strategy for retirement investing?

DCA is highly effective for long-term investors because it removes timing risk, enforces discipline, and smooths volatility. While lump sum investing can sometimes deliver higher returns, simulations show that DCA offers peace of mind and consistent results for retirement planning.

How much should I contribute each month?

It depends on your income, expenses, and retirement goals. Use a DCA retirement calculator to test different amounts. A good rule of thumb is to save 10–20% of your income toward retirement if possible.

Should I combine lump sum and DCA?

Yes. Many investors combine a lump sum (e.g., a bonus or inheritance) with ongoing DCA contributions. This strategy maximizes growth while still reducing timing risk. Our DCA vs Lump Sum guide compares both approaches in detail.

What if I start investing late?

Starting late reduces compounding time, but it’s never too late. Increase your monthly contributions and consider extending your retirement age by a few years. Simulations can show you exactly how these adjustments impact your outcomes.

✅ Conclusion & Next Steps

Retirement doesn’t have to be a guessing game. By running a retirement DCA simulation, you gain clarity, confidence, and control over your financial future. DCA ensures steady growth, while simulation helps you test scenarios, optimize contributions, and prepare for different market outcomes.

The key takeaways are simple:

- Start early—even small contributions add up over decades.

- Use a DCA calculator to test realistic retirement outcomes.

- Optimize with budgeting (WhatIfBudget) and advanced tools (Premium Simulator).

- Stay disciplined and automate your contributions.

👉 Recommended reads to deepen your financial knowledge:

- Money: Master the Game – by Tony Robbins, a comprehensive guide to financial freedom.

- The Psychology of Money – by Morgan Housel, exploring how behavior impacts investing success.

If you’re ready to take control, start with our free Investment Simulator, then upgrade to our Premium DCA Simulator for advanced retirement simulations.

📚 Related Articles

📖 Recommended Books

Want to deepen your financial knowledge? Here are two highly recommended reads:

For Canadian investors, consider opening a free account with Wealthsimple to start your retirement plan easily.