💰 How Much Should You Save Each Month? Rule of Thumb vs Reality

One of the most common questions in personal finance is: how much should you save monthly? While experts often cite the “20% savings rule”, the truth is that the right number depends on your income, lifestyle, and goals. For many households, rising housing costs, debt payments, and inflation make it difficult to reach these benchmarks—while high earners may have room to save much more.

According to recent surveys, the average savings rate in the U.S. is below 7%—far from the recommended 15–20%. This gap highlights why rules of thumb can feel discouraging or unrealistic. Instead of blindly following one-size-fits-all advice, it’s more useful to adapt your savings strategy to your personal situation.

In this in-depth guide, we’ll cover:

- ✅ Why saving monthly matters more than lump sums

- ✅ The pros and cons of the 20% rule

- ✅ How cost of living affects savings ability

- ✅ Practical methods to calculate your ideal savings rate

- ✅ Tools and strategies to grow savings into wealth

By the end, you’ll know exactly how to strike the right balance between financial security and wealth building, and you’ll leave with practical steps you can start applying today.

🏦 Why Saving Monthly Matters

Saving money each month is the cornerstone of financial independence. Without a structured savings habit, big financial goals like buying a home, investing for retirement, or starting a business remain out of reach. The truth is that wealth is rarely built in a single moment—it’s accumulated through small, consistent actions.

💡 For example, saving just $200 a month with a 6% annual return over 30 years grows to nearly $200,000. If you increase that to $500/month, you’re looking at almost $500,000. This demonstrates that saving isn’t about one-time windfalls but about consistency and compounding.

🔐 Savings = Security + Growth

Monthly savings serve two distinct purposes:

- Financial security: An emergency fund (typically 3–6 months of expenses) protects you from unexpected events—medical bills, job loss, car repairs. Without it, even small shocks can push you into debt.

- Wealth building: Long-term savings, when invested, grow through compounding and provide future stability (retirement, property purchase, passive income).

📊 Example: The Power of Consistency

| Monthly Savings | 10 Years | 20 Years | 30 Years |

|---|---|---|---|

| $100 | $16,400 | $46,200 | $100,000 |

| $200 | $32,800 | $92,400 | $200,000 |

| $500 | $82,000 | $231,000 | $500,000 |

👉 The takeaway: consistency beats intensity. Saving smaller amounts regularly is more powerful than saving big amounts occasionally. Start small, automate contributions, and increase gradually. Use our free WhatIfBudget tool to see how much you can realistically save every month.

📊 The 20% Savings Rule Explained

The 50/30/20 rule is one of the most popular budgeting frameworks in personal finance. It was popularized by U.S. Senator Elizabeth Warren in her book All Your Worth and has since become a global benchmark for financial planning. The principle is simple: split your after-tax income into three main categories:

| Category | Percentage | Examples |

|---|---|---|

| Needs | 50% | Rent, groceries, utilities, insurance, minimum debt payments |

| Wants | 30% | Dining out, entertainment, shopping, subscriptions, travel |

| Savings & Debt Repayment | 20% | Emergency fund, retirement accounts, extra debt payments, investments |

While this model provides a simple starting point, reality often looks different. In high-cost-of-living cities like New York, Toronto, or London, rent alone can exceed 40–50% of income, leaving little for “wants” or savings. On the flip side, high-income households may easily cover needs with 30–40% of income, allowing them to save 30–40% instead of just 20%.

📉 Research shows that most Americans save less than 7% of their income—far below the 20% rule (Investopedia). That gap illustrates why rules of thumb should be seen as guidelines, not rigid rules.

👉 Want to see how this rule would apply to your own income? Use our free WhatIfBudget tool to test the 50/30/20 split and adjust it to your real-life expenses.

🏠 Reality Check: Cost of Living vs Savings

Saving money is easier said than done. With the cost of living rising every year—especially in housing, food, healthcare, and childcare—many households struggle to set aside even a small percentage of their income. In fact, surveys show that nearly 60% of Americans live paycheck to paycheck, while average savings rates hover below 7% of income. This gap between financial advice (“save 20%”) and reality is why many people feel stuck.

Here’s how cost of living impacts savings potential across income levels:

| Household Type | Fixed Expenses (% Income) | Typical Savings Potential | Key Challenge |

|---|---|---|---|

| High-income | 40–50% | 30–40% of income | Lifestyle creep (spending grows with income) |

| Middle-income | 60–70% | 10–20% of income | Balancing debt payoff with savings |

| Low-income | 70–85% | 5% or less of income | Rising essentials leave little room to save |

👉 The solution isn’t always about extreme cutting. It’s about balancing three levers:

- Cutting expenses – renegotiate rent, cancel unused subscriptions, cook more at home.

- Increasing income – ask for a raise, start a side hustle, freelance part-time.

- Automating savings – set up transfers on payday so saving happens first, not last.

💡 Try our free WhatIfBudget tool to map your income and expenses. Many users discover they can save an extra $100–$300/month just by making small adjustments.

🧮 How to Calculate Your Ideal Monthly Savings

The question “how much should I save monthly?” doesn’t have a single answer. The right amount depends on your income, expenses, lifestyle, goals, and time horizon. A student saving for an emergency fund will need a very different plan than a professional aiming for early retirement. Instead of copying a generic rule, calculate your own number with a structured approach.

📌 Step-by-Step Framework

- List your financial goals – emergency fund, house down payment, retirement, vacations.

- Assign time horizons – short-term (1–3 years), medium-term (3–7 years), long-term (7+ years).

- Estimate target costs – e.g., $20,000 for a down payment in 5 years.

- Break it down monthly – $20,000 ÷ 60 months = $333/month.

- Add a safety buffer – to account for inflation, unexpected expenses, or lifestyle upgrades.

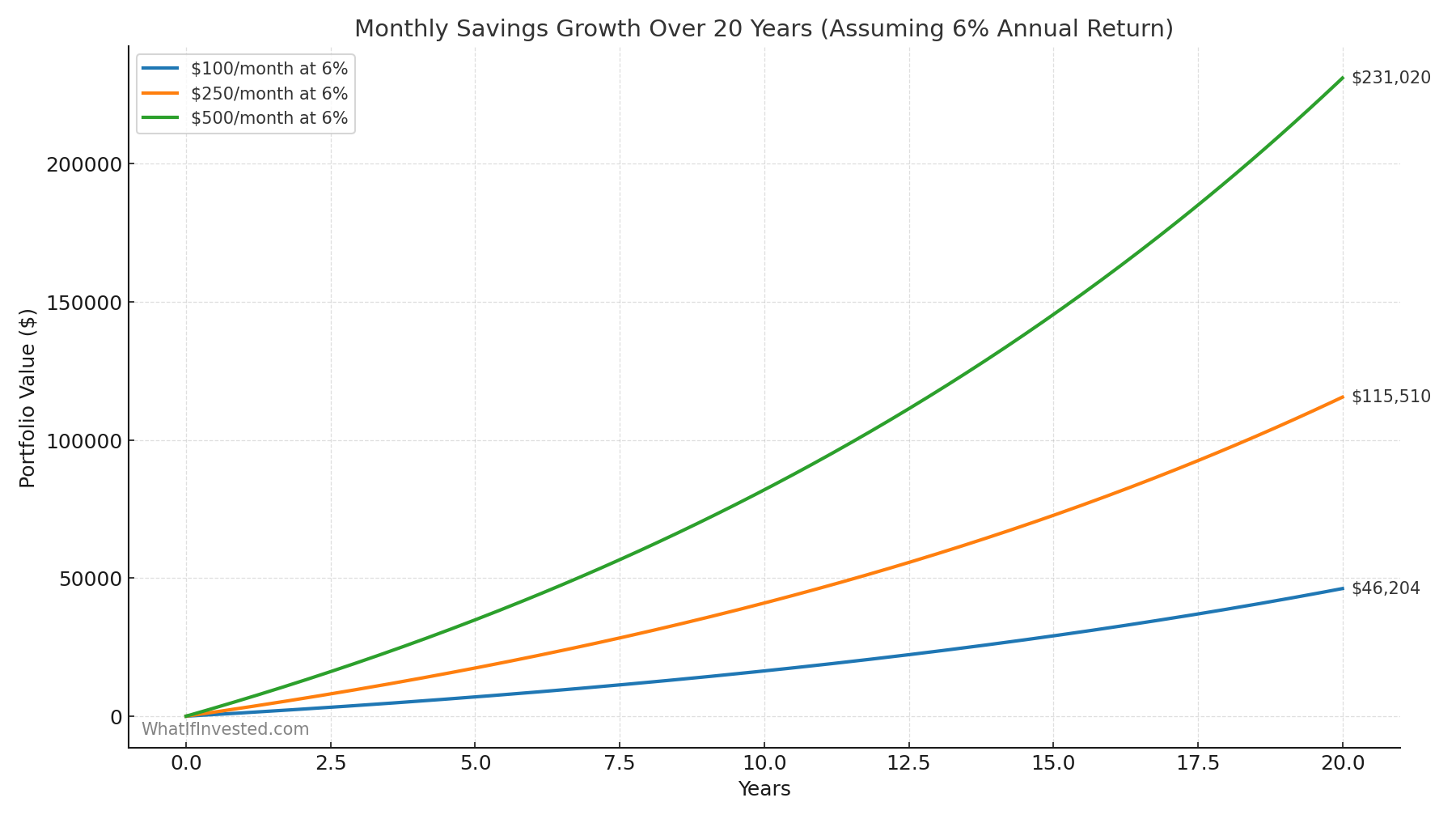

📊 Example Monthly Savings Growth

Here’s what different savings levels can grow into over 20 years (assuming a 6% annual investment return, compounded monthly):

| Monthly Savings | 5 Years | 10 Years | 20 Years |

|---|---|---|---|

| $100 | $6,800 | $16,400 | $46,200 |

| $250 | $17,000 | $41,000 | $115,500 |

| $500 | $34,000 | $82,000 | $231,000 |

👉 Use our free DCA Calculator to run your own projections and see how monthly savings accumulate when invested in ETFs, stocks, or crypto. Comparing pure saving with investing often reveals how powerful compounding really is.

📌 Rule of thumb: Aim to save at least 15% of your income. If you can’t reach that yet, start small—even 5% matters. What counts is consistency, then gradually increasing your rate as your income grows.

📲 Budgeting Tools & Simulators

One of the most effective ways to save more is to track your money. Without visibility, savings usually become an afterthought. The good news? Modern tools make it easier than ever to analyze, plan, and automate your savings habits. Depending on your preferences, you can choose between apps, spreadsheets, or interactive simulators.

🔧 Popular Tools to Manage Your Budget

- WhatIfBudget – Free, mobile-first, and no login required. Perfect for quickly creating a monthly budget and spotting savings opportunities in minutes.

- Investment Simulator – Test how different savings strategies (DCA, lump sum, ETFs, crypto) would have performed using real historical data.

- Premium Simulator – Advanced scenario planning with features like portfolio rebalancing, multiple goals tracking, and long-term retirement projections.

- Bank apps – Most major banks now provide built-in expense categorization, but often limited in features and flexibility.

- Spreadsheets – The old-school classic. Highly customizable, but requires discipline, formulas, and manual updates.

📊 Comparison at a Glance

| Tool | Best For | Pros | Cons |

|---|---|---|---|

| WhatIfBudget | Beginners & mobile users | Free, instant setup, no login | Basic vs premium apps |

| Investment Simulator | Investors testing strategies | Real historical data, DCA vs lump sum | Doesn’t replace a full budget tool |

| Premium Simulator | Advanced planners & high savers | Scenario modeling, rebalancing, multi-goals | Paid upgrade |

| Bank Apps | Everyday expense tracking | Integrated with accounts | Limited customization |

| Spreadsheets | DIY power users | Flexible, unlimited control | Manual, time-consuming |

💡 Pro tip: The best results come from automation. Set up a recurring transfer the day after payday. That way, saving happens before spending—it turns saving from a “maybe” into a “guarantee.”

👉 Want to explore how today’s savings shape tomorrow’s wealth? Try our Premium Simulator for advanced planning, or start free with WhatIfBudget.

📈 Investing vs Saving: Where Should Money Go?

One of the most common dilemmas in personal finance is deciding between saving and investing. Both play a crucial role, but they serve very different purposes. Savings accounts provide safety and liquidity, while investments deliver growth and wealth-building—but with volatility. The right mix depends on your goals, time horizon, and risk tolerance.

| Goal | Time Horizon | Best Place |

|---|---|---|

| Emergency Fund | 0–2 years | High-yield savings account or money market fund |

| Vacation, car purchase | 1–3 years | Savings account, GICs/CDs, or short-term bond ETFs |

| Home down payment | 3–7 years | Conservative mix: 60% savings / 40% bond ETFs |

| Retirement | 10–40 years | Index funds, diversified ETFs, retirement accounts |

| Wealth building | Ongoing | DCA into stocks, ETFs, and alternative investments |

💡 A good rule of thumb: save for the short term, invest for the long term. For example, $500/month in a high-yield savings account might grow to $180,000 after 30 years. But if invested with a 7% annual return, the same contributions grow to nearly $600,000. That’s the power of compounding—and why investing is essential for long-term wealth.

Of course, risk management matters. Keep your emergency fund in cash, but don’t let inflation eat away at money intended for the future. The ideal strategy is a hybrid approach: protect short-term needs with savings while letting your long-term money grow through investing.

👉 Want to see the difference for yourself? Use our Investment Simulator to compare saving vs investing scenarios and check our guide Is DCA Worth It in 2025?.

⚡ Advanced Strategies for High Savers

If you’re already saving 20% or more of your income, congratulations—you’re far ahead of the average household. But reaching this level opens up new challenges: how to optimize savings so your money works harder without unnecessary risk or tax drag. Here are advanced strategies for high savers:

📊 Maximize Tax Efficiency

Before investing in taxable accounts, fully fund tax-advantaged accounts. In Canada, that means maxing out your TFSA for tax-free growth and RRSP for tax-deferred compounding. In the US, focus on IRA and 401(k) accounts. Tax efficiency can add hundreds of thousands to your portfolio over decades.

🤖 Automate & Diversify

Consider using robo-advisors like Wealthsimple or low-cost index ETFs. High savers often overcomplicate strategies—automation ensures consistency while diversification reduces risk.

🎯 Align Savings With Multiple Goals

- Short-term: Vacation fund, emergency savings.

- Medium-term: House down payment, business capital.

- Long-term: Retirement, financial independence.

Segmenting contributions helps you stay motivated, as you see progress on both near and distant goals.

🔄 Rebalance & Adjust Risk

Review your portfolio annually. If stocks have outperformed and now represent 80% instead of 70% of your portfolio, rebalance to avoid excess risk. As you approach major goals (like retirement or home purchase), shift toward safer assets gradually.

🌱 Lifestyle Design & Income Allocation

One of the most overlooked high-saver advantages is lifestyle design. Instead of letting promotions or raises fuel “lifestyle creep” (bigger house, fancier car), redirect that extra income straight into savings or investments. Over time, this habit is what transforms high earners into millionaires—even without windfall luck.

👉 If you’re already a high saver, challenge yourself to simulate different scenarios with our Investment Simulator. See how increasing contributions by just 5% accelerates your journey to financial independence.

🧠 Psychology of Saving & Consistency

Saving money isn’t just a numbers game—it’s a psychological battle. Most people know they should save, but few manage to do it consistently. The difference often lies in behavioral finance: how our brains perceive effort, reward, and delayed gratification.

📊 Studies in behavioral economics show that people who “pay themselves first” (automatic transfers to savings/investments right after payday) save 2–3x more than those who try to save “what’s left” at the end of the month. This is because saving becomes a default habit instead of a conscious sacrifice.

💡 Psychological hacks for better saving:

- Start tiny – Even saving $5/day ($150/month) builds momentum. Habits matter more than amounts at first.

- Visualize goals – Rename your accounts “Freedom Fund,” “Dream House,” or “Travel 2026” to make saving feel rewarding.

- Gamify progress – Use apps or trackers that reward milestones. Hitting small wins keeps motivation high.

- Automate increases – Schedule a 1% savings rate increase every year or after each raise—your lifestyle adjusts naturally.

- Anchor your identity – Think of yourself as “a saver” rather than someone “trying to save.” Identity-based habits stick longer.

📈 Consistency vs Perfection

Imagine two people: one saves $300/month consistently, the other saves $1,000 sporadically every few months. Over 10 years, the consistent saver often ends up with more wealth, thanks to compounding and discipline. Regularity beats occasional intensity.

| Saver Type | Monthly Savings | Years | Total Saved |

|---|---|---|---|

| Consistent Saver | $300 every month | 10 years | $36,000 (+ growth) |

| Irregular Saver | $1,000 every 4 months | 10 years | $30,000 (+ less growth) |

👉 The lesson: consistency compounds faster than perfection. Automate your savings, stick with it, and let time and compounding do the heavy lifting. Use tools like WhatIfBudget to track progress and Investment Simulator to visualize long-term growth.

📚 Books & Resources for Mastering Savings

If you want to go deeper, learning from experts is invaluable. Here are some must-read resources:

- Money: Master the Game – Tony Robbins explains long-term wealth principles.

- The Intelligent Investor – Timeless investing wisdom by Benjamin Graham.

- The 50/30/20 Budget Rule Explained – Learn how to apply a simple framework for saving.

- Bogleheads Wiki – Community-driven guide to investing and saving smartly.

Knowledge is a form of financial leverage. The more you understand personal finance, the less likely you are to fall for bad advice, and the more confident you become in your own plan.

🚀 Take Your Savings Strategy to the Next Level

Don’t just save—invest wisely. Use our Investment Simulator to test how monthly savings grow in ETFs, stocks, or Bitcoin. For advanced insights, check our Premium DCA Calculator.

📚 Recommended Reads:

💡 Ready to automate investing? Start with Wealthsimple, Canada’s leading robo-advisor.

❓ Frequently Asked Questions

What is a good savings percentage per month?

Most financial experts recommend saving between 15% and 20% of your income. This target helps you build an emergency fund, plan for retirement, and cover future goals. However, if your budget is tight due to high rent or debt, don’t worry—starting with 5–10% can still create momentum. The key is consistency and gradually increasing your savings rate whenever you get a raise, bonus, or reduce expenses.

Should I pay debt or save first?

The best approach is a hybrid strategy. Start by building a small emergency fund (about $1,000 or one month of expenses) to cover unexpected costs. Next, prioritize paying down high-interest debt like credit cards, as the interest often exceeds what you’d earn by investing. Once debt is under control, balance ongoing repayments with consistent monthly savings and investments.

How much should I have saved by age 30, 40, and 50?

While everyone’s situation is different, a common benchmark is: by 30, save the equivalent of your annual salary; by 40, three times your salary; by 50, six times your salary; and by 60, eight to ten times your salary. These milestones assume steady contributions and compounding over time.

Is it better to save monthly or invest monthly?

Both are important, but their purpose differs. Saving provides short-term security (emergency fund, near-term goals), while investing grows wealth long term (retirement, wealth building). Ideally, you should do both: keep 3–6 months of expenses in savings, then invest additional monthly contributions into diversified assets like ETFs or index funds.

What if I can’t save 20% of my income?

Don’t be discouraged. Even small amounts saved consistently matter. Start with $25, $50, or whatever you can afford. Automate it to remove decision fatigue. Over time, focus on increasing income (side hustles, promotions) or reducing expenses (subscriptions, housing costs) to gradually boost your savings rate. Remember, savings is a journey, not a race.

Where should I put my monthly savings?

It depends on your goals. For emergency funds, use a high-yield savings account. For short-term goals (1–3 years), consider GICs or CDs. For long-term goals (10+ years), investing in index funds or ETFs typically provides better growth. The combination of safety + growth ensures you cover both short-term stability and long-term wealth building.