🛟 Emergency Fund Calculator: How Much Do You Really Need?

An emergency fund is more than just a pile of cash—it’s the foundation of financial security. Without it, a single unexpected event—job loss, medical bill, car repair, or even a surprise relocation—can push you into debt and derail years of progress. With it, you buy yourself time, freedom, and peace of mind.

But here’s the problem: how much is enough? Financial experts often recommend saving 3–6 months of expenses, while some say 12 months is safer. According to a 2024 Investopedia survey, nearly 60% of Americans can’t cover a $1,000 emergency without borrowing. That means the “rules of thumb” are far from reality for most households.

The truth is, your emergency fund target depends on your income stability, family size, debt load, and lifestyle. A single professional in a stable career might feel safe with three months, while a freelancer with two kids might need 12 months or more.

👉 In this comprehensive guide, we’ll show you how to:

- ✅ Use our free Emergency Fund Calculator to find your number.

- ✅ Compare 3, 6, and 12-month strategies with real-life scenarios.

- ✅ Learn where to keep your fund (and where not to).

- ✅ Balance emergency savings with investing for long-term growth.

By the end, you’ll know exactly how much you should save, where to put it, and how to build it without feeling overwhelmed. Plus, you’ll discover advanced tools like our Investment Simulator and Premium Scenarios to stress-test your finances against real-world risks.

🏦 Why an Emergency Fund Matters

An emergency fund isn’t just about money—it’s about financial resilience. Life is unpredictable. A sudden job loss, medical bill, car breakdown, or urgent travel can wipe out your checking account in days. Without a safety net, many people fall back on credit cards or personal loans, which often come with 20%+ interest rates. That can turn a short-term problem into years of debt.

According to a 2024 Bankrate survey, 57% of Americans cannot cover a $1,000 emergency without borrowing. This means most households are only one crisis away from financial instability. Even in Canada, studies show that nearly half of households would struggle to handle a $2,000 surprise expense without credit. These numbers prove why having a dedicated buffer is essential.

💡 Start with a starter emergency fund of $500–$1,000. This small cushion covers minor shocks like a car repair or medical copay. Once in place, build toward the standard 3–6 months of essential expenses. For example, if your monthly fixed expenses (housing, utilities, food, transportation) total $2,500, you’ll want at least $7,500 for a 3-month buffer, and ideally $15,000 for 6 months.

Think of your emergency fund as insurance for your future self. It won’t make you rich, but it buys peace of mind—and prevents you from derailing long-term goals like investing, buying a home, or retiring on time. Without it, your wealth-building plan can collapse at the first sign of trouble.

👉 Use our free WhatIfBudget tool to quickly calculate your monthly expenses and see how much you should aim to save in your own emergency fund.

🧮 How the Emergency Fund Calculator Works

Our Emergency Fund Calculator removes the guesswork. Instead of sticking to generic advice like “save 6 months of income,” it adapts the target to your real life—factoring in monthly expenses, job stability, dependents, and risk tolerance.

📌 Step-by-step process:

- Enter your monthly expenses: rent/mortgage, utilities, groceries, insurance, transportation, debt payments.

- Choose your income type: salaried (stable), commission-based (variable), or self-employed/freelance (unpredictable).

- Add dependents: more family members = higher buffer needed for safety.

- Select your buffer months: 3 months (basic), 6 months (standard), 12 months (maximum safety).

📊 Example Calculation

If your monthly expenses are $3,000 and you want a 6-month cushion:

Formula → Monthly Expenses × Months of Coverage = Emergency Fund Target

| Monthly Expenses | 3 Months | 6 Months | 12 Months |

|---|---|---|---|

| $2,000 | $6,000 | $12,000 | $24,000 |

| $3,000 | $9,000 | $18,000 | $36,000 |

| $4,000 | $12,000 | $24,000 | $48,000 |

👉 Our free WhatIfBudget tool lets you input your expenses and instantly calculate a realistic emergency fund target. And with our Investment Simulator, you can explore how diverting part of your savings into investments impacts your long-term growth.

📊 3, 6, or 12 Months? Which Rule Fits You?

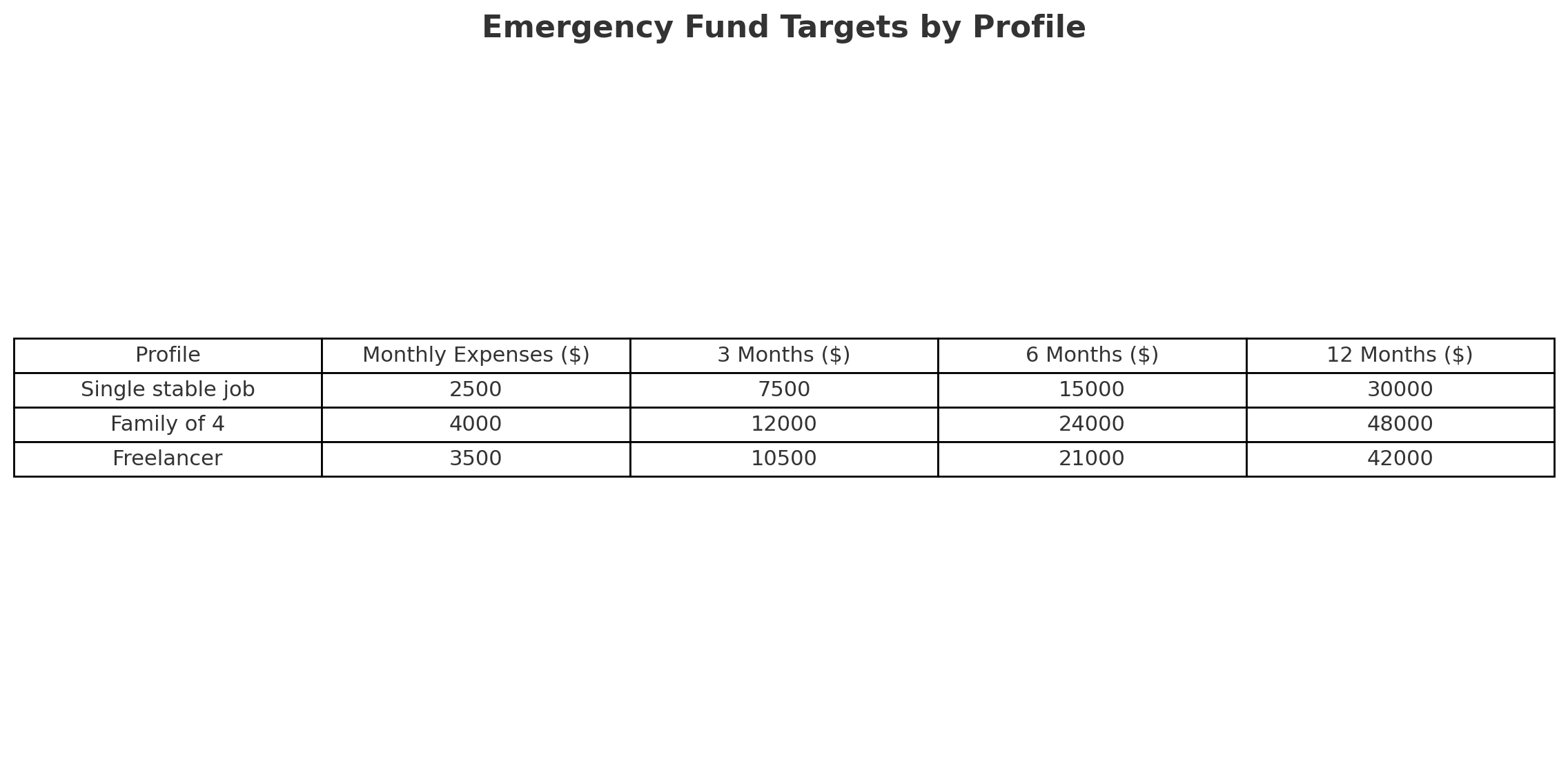

Financial experts usually recommend an emergency fund of 3–6 months of essential expenses. However, the right buffer for you depends on your lifestyle, job stability, and risk profile. Here’s how to think about it:

✔️ 3 Months of Expenses

Best for people with stable, salaried jobs and no dependents. If you rent, have minimal debt, and could quickly find another job, three months may be enough. For example, with $2,500 in monthly expenses, your target is $7,500. The risk: one prolonged unemployment period could still wipe out your fund.

✔️ 6 Months of Expenses

The “gold standard” for most households. It offers stronger protection against layoffs, medical issues, or unexpected costs. A family with $4,000 in monthly expenses would aim for $24,000. This balance avoids tying up too much cash while still providing peace of mind.

✔️ 12 Months of Expenses

Best for freelancers, business owners, or those in unstable industries (startups, seasonal jobs, gig economy). If your monthly fixed costs are $3,500, one year of expenses = $42,000. This creates a large cushion but comes with the trade-off of locking away capital that could otherwise be invested.

👉 Not sure which rule fits you? Run different scenarios with our DCA Calculator to see how quickly small monthly contributions can build each level of safety.

📘 For more context on how these percentages fit into overall budgeting, check our guide: The 50/30/20 Budget Rule Explained.

📋 How to Calculate Your Expenses

The foundation of an accurate emergency fund calculator is knowing your true monthly expenses. Many people underestimate their costs because they forget “irregular” items like annual insurance premiums, back-to-school shopping, or holiday gifts. If you only track rent and groceries, you’ll create a fund that’s too small and could collapse under pressure.

🔎 Expense Categories to Include

- Fixed costs: rent/mortgage, utilities, insurance, debt payments.

- Variable costs: groceries, gas, subscriptions, transportation.

- Occasional costs: car repairs, annual medical deductibles, home maintenance, school fees.

- Discretionary: dining out, entertainment, hobbies, shopping.

📊 Example Breakdown

| Category | Monthly Cost |

|---|---|

| Housing & Utilities | $1,500 |

| Food & Groceries | $600 |

| Transportation | $400 |

| Insurance & Debt | $500 |

| Miscellaneous | $250 |

| Total | $3,250 |

👉 In this case, a 6-month emergency fund should cover $19,500. Rounding up to $20,000 provides extra safety against inflation and surprise bills.

💡 Pro tip: Treat irregular costs as “mini sinking funds.” For example, if car repairs average $1,200/year, set aside $100/month. This way, your emergency fund stays intact for true emergencies only.

Start today with our free WhatIfBudget tool to map out your expenses, then multiply by 3, 6, or 12 to set your target.

🏦 Where to Keep Your Emergency Fund

Your emergency fund must check three boxes: safe, liquid, and accessible. It should never be exposed to market volatility, and you should be able to withdraw funds quickly when life throws surprises at you. At the same time, you don’t want it sitting in a zero-interest account losing value to inflation.

📌 Best Options

| Option | Pros | Cons |

|---|---|---|

| High-Yield Savings Account | Safe, FDIC/CDIC insured, easy access, earns interest | Rates may not keep up with inflation |

| Money Market Account | Higher yields, limited check-writing privileges | Requires higher balances, may limit withdrawals |

| Certificates of Deposit (CDs) / GICs | Safe, fixed rate, predictable returns | Funds locked until maturity; limited liquidity |

💡 Practical Setup

A common strategy is to split your fund: keep 1–2 months of expenses in a high-yield savings account for instant access, and place the rest in a money market account or short-term CDs/GICs to earn more interest. This way, you combine liquidity + yield.

🚫 Avoid putting your emergency fund in stocks, ETFs, or crypto. While excellent for long-term growth, their volatility can destroy your safety net right when you need it most.

👉 Looking for an automated way to grow beyond your emergency fund? Consider robo-advisors like Wealthsimple for investments once your fund is complete. And don’t miss our guide What If You Invested During the 2008 Crisis? for insights on balancing safety vs growth.

📈 Balancing Emergency Funds vs Investing

One of the most common personal finance dilemmas is: should I keep saving more in my emergency fund, or start investing excess cash? The reality is that you need both—but the balance depends on your stage of life, income stability, and risk tolerance.

🛠️ Step-by-step priorities

- Stage 1 – Starter Fund: Build a quick buffer of $1,000–$3,000. This prevents small emergencies (flat tire, broken laptop) from becoming debt traps.

- Stage 2 – Standard Fund: Expand to 3–6 months of essential expenses. This level covers most job losses and major unexpected bills.

- Stage 3 – Advanced Stability: Cap your emergency fund at 6–12 months. Beyond that, excess savings should go into investments where they can grow.

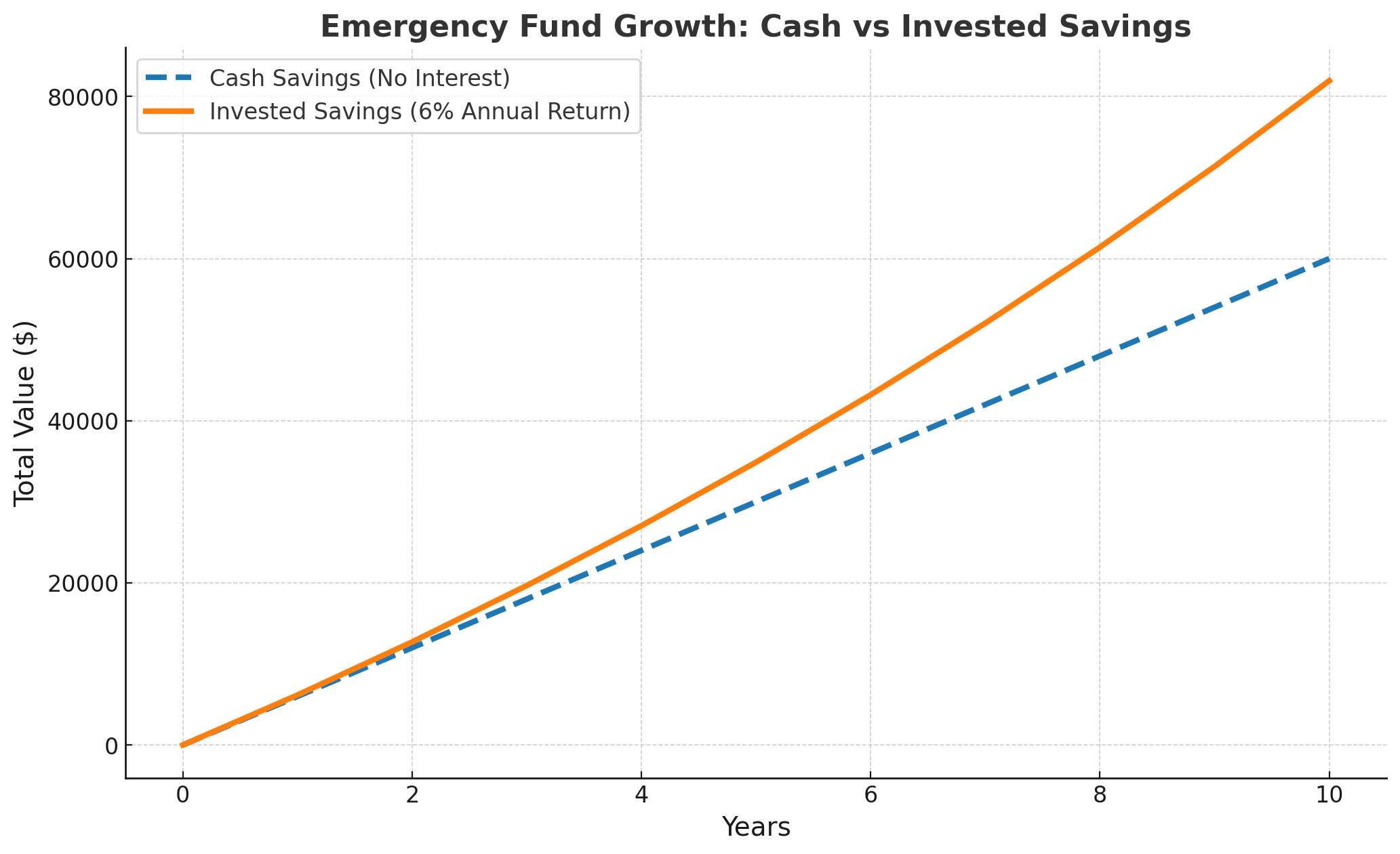

📊 Example Comparison

If you save $500/month for 10 years:

- Kept in cash: $60,000 (safe, but losing value to inflation).

- Invested at 7% average return: ≈ $86,000 (an extra $26,000 in growth).

This difference illustrates the danger of “cash drag”—keeping too much idle cash that loses purchasing power over time.

⚖️ The Balance

Think of your emergency fund as insurance and your investments as wealth builders. Once you reach your comfort level with savings, every extra dollar should be put to work in the markets.

👉 Run the numbers with our Investment Simulator and explore advanced scenarios with our Premium tools to see how balancing savings and investments shapes your long-term wealth.

👨👩👧 Advanced Scenarios: Families, Freelancers & Expats

Not everyone needs the same size emergency fund. Your job stability, family situation, and even your location can dramatically affect the target you should aim for. This is where the emergency fund calculator goes beyond the “3–6 months” rule of thumb.

👨👩👧 Families with Children

Kids add unpredictable costs: medical bills, school supplies, extracurricular activities, childcare. A family spending $4,000 per month should plan for $24,000 (6 months) to $48,000 (12 months). This buffer ensures stability even if one parent loses income.

💼 Freelancers & Gig Workers

Irregular income means you may go weeks or months without stable cash flow. If your average monthly expenses are $3,500, you should target 9–12 months, or about $31,500–$42,000. This cushion allows you to weather slow periods without debt.

🌍 Expats Living Abroad

When living overseas, emergencies can be more expensive. International flights, visa renewals, or unexpected healthcare costs add up quickly. If your monthly expenses are $5,000, a 12-month fund of $60,000 provides maximum security and flexibility.

👫 Dual-Income Households

If both partners have stable salaried jobs, you may be able to keep a smaller buffer. For example, with $3,000 in monthly expenses, a 3–6 month fund of $9,000–$18,000 may be sufficient.

💡 Rule of thumb: the more unstable or unpredictable your income, the larger your emergency fund should be. Think of it as a “risk multiplier.”

👉 Use our Premium Simulators to stress-test your finances. You can model scenarios like job loss, reduced income, or unexpected relocation to see how your emergency fund holds up.

🛠️ Tools & Simulators to Plan Smarter

Building an emergency fund doesn’t need to be overwhelming. The right tools can make the process faster, easier, and even enjoyable. Here are our recommended resources:

- WhatIfBudget – Free, mobile-first, no login. Quickly track expenses and set savings targets.

- DCA Calculator – See how regular contributions build over time.

- Investment Simulator – Test scenarios where you balance saving and investing.

- Premium Simulator – Unlock features like auto-rebalancing and goal-based savings plans.

👉 These tools remove the guesswork. Instead of asking “am I saving enough?”, you can model outcomes and adjust in real time.

📚 Best Books & Resources on Financial Security

If you want to go deeper, here are expert-approved books to strengthen your financial foundation:

- Rich Dad Poor Dad – Classic on money mindset and building assets.

- The Psychology of Money – Timeless lessons on behavior and wealth.

- Money: Master the Game – Strategy-focused book with actionable tips.

- The Intelligent Investor – The bible of value investing.

For automated investing, check out Wealthsimple, a robo-advisor that balances cost and simplicity.

👉 Also explore our blog for related guides: How to Make a Monthly Budget, 50/30/20 Budget Rule Explained, and Best Free Budget Planners in 2025.

❓ Frequently Asked Questions

How much should I keep in my emergency fund?

Most experts suggest 3–6 months of essential expenses. Freelancers, families with children, and expats may need closer to 9–12 months for maximum security.

Where should I store my emergency fund?

High-yield savings accounts, money market funds, or short-term CDs/GICs are the safest options. These combine liquidity with modest returns. Avoid risky assets like stocks or crypto.

Should I build an emergency fund before investing?

Yes. Always build a starter buffer of $1,000–$3,000 first. Once you have at least 3 months covered, you can begin investing while continuing to grow your emergency fund.

Can I use my emergency fund for planned expenses?

No. Planned expenses (vacations, car purchases, weddings) should have sinking funds. Your emergency fund is only for unexpected, urgent costs.

How quickly should I build my emergency fund?

There’s no one-size timeline. A good target is to save at least 1 month of expenses within 6 months, then grow steadily toward 3–6 months over 1–3 years. Automating savings accelerates the process.

Should I invest part of my emergency fund?

Generally no. Emergency funds must be safe and liquid. However, once you exceed 6–12 months, any excess can be invested in index funds, ETFs, or retirement accounts.

Do I need an emergency fund if I have a line of credit?

Yes. Credit is not a substitute. In a crisis, lenders can reduce limits or increase interest rates. A cash buffer gives you independence and avoids additional debt.