The Top 5 ETFs for Passive Investing in 2025 (Canada & USA) 📊

Introduction

In today’s fast-paced markets, extreme volatility and rapid technological disruption can unsettle even the most seasoned investors. Against this backdrop, passive investing through low-cost Exchange-Traded Funds (ETFs) has emerged as a time-tested strategy for building long-term wealth with minimal ongoing effort. By aggregating hundreds or thousands of securities into a single vehicle, ETFs deliver instant diversification, professional management of index replication, and highly transparent fee structures. In 2025, investors on both sides of the Canada–U.S. border are spoilt for choice—but selecting the right combination of funds requires a careful balance of cost, coverage, tax efficiency, and liquidity.

This strategic comparison will guide you through the five standout ETFs that form the core of a resilient, tax-sensitive passive portfolio. We begin with broad-market equity foundations—covering both the expansive U.S. market (VTI, SCHB) and the uniquely Canadian landscape (XIC)—before introducing fixed-income ballast via the BMO Aggregate Bond Index ETF (ZAG). Finally, we examine how a targeted technology tilt (QQQ) can amplify growth potential within a balanced asset mix. Whether you are a novice investor just setting up your first TFSA or a veteran portfolio manager optimizing multi-jurisdictional exposure, our deep dive offers actionable insights backed by historical performance data, index methodologies, and real-world tax considerations.

Along the way, we’ll unpack each ETF’s expense ratio, underlying index design, average daily volume, and assets under management, then assess how these factors translate into real-world net returns after fees, taxes, and trading costs. Special attention is paid to cross-border issues—highlighting when to use RRSPs vs. TFSAs in Canada, or IRAs and 401(k)s in the U.S.—so you can minimize withholding taxes and maximize compounded growth. We also profile each issuer’s reputation and product stability, ensuring you only commit capital to funds with robust operational frameworks.

By the end of this section, you’ll have a clear roadmap for constructing a passive ETF portfolio tailored to your individual goals—whether that means steady income, low-cost market tracking, or a strategic growth overlay. Ready to navigate the complexities and seize the advantages of ETF investing in 2025? Let’s dive into our detailed methodology and start building your optimal passive allocation.

Methodology & Selection Criteria

To deliver a truly rigorous technical comparison of the top passive ETFs for 2025, we established a structured evaluation framework focused on six core dimensions. Each dimension was chosen to reflect both quantitative and qualitative factors that directly impact an investor’s net returns, risk management, and ease of implementation. Our analysis balances historical data, forward-looking considerations, and real-world tax implications for both Canadian and U.S. investors.

- Expense Ratio: We prioritized ultra-low management fees, since every basis point directly erodes long-term returns. For each ETF, we compared the published net expense ratio against industry peers, and calculated the drag on cumulative performance over 1, 3, and 5 years. This approach highlights the compounding effect of fees on a $10,000 investment grown over a decade.

- Underlying Diversification: True passive investing requires broad exposure across market capitalizations, sectors, and regions. We assessed the number of holdings, sector weights, and geographic allocation for each fund. ETFs with excessive concentration in a handful of stocks or single industries scored lower than those offering comprehensive coverage of small-, mid-, and large-cap equities (or diversified bond segments for fixed-income funds).

- Historical Performance: Using total return data from 2015 through 2024, we annualized returns over 1-, 3-, and 5-year horizons to gauge consistency and resilience across different market cycles—including bull runs and corrections. We also measured volatility (standard deviation) and maximum drawdown to provide context on risk-adjusted performance, rather than raw gains alone.

- Tax Efficiency: ETF structure and domicile can dramatically affect after-tax returns. For U.S. investors, we reviewed qualified dividend treatment and capital gains distribution frequency. For Canadian investors, we examined withholding tax on U.S. dividends, eligibility for the dividend tax credit, and the benefits of holding certain ETFs inside registered accounts (TFSA, RRSP). Funds structured to minimize annual capital gains distributions scored highest.

- Liquidity & Tradability: High average daily volume and tight bid-ask spreads ensure cost-effective execution, especially for larger transactions. We analyzed 12-month average trading volume and average bid-ask spread percentage. ETFs with daily liquidity above $100 million and spreads below 0.05% received top marks, as these parameters reduce slippage and market impact.

- Issuer Reputation & Stability: The long-term viability of an ETF depends on its sponsor’s experience, asset base, and track record. We evaluated fund providers (Vanguard, iShares, Schwab, BMO, Invesco) on assets under management, product shelf history, and instances of fund closures or mergers. Well-capitalized issuers with no history of sudden closures earned higher confidence scores.

Our data sources include Morningstar Direct, SEDAR filings, the SEC’s EDGAR database, and broker-dealer fact sheets to ensure accuracy and timeliness. All performance figures are net of fees and assume reinvestment of distributions. While historical results do not guarantee future returns, this methodology offers a robust framework to identify ETFs that combine low cost, broad diversification, tax savvy structures, and strong liquidity––key ingredients for successful passive portfolios in 2025 and beyond.

1. Vanguard Total Stock Market ETF (VTI)

Expense Ratio: 0.03% annually

Underlying Index: CRSP US Total Market Index

Issuer: Vanguard

Average Daily Volume: 4 million shares

Assets Under Management: $2.5 trillion

Inception Date: May 24, 2001

Key Features

- True Total Market Coverage: Holds over 4,000 U.S. stocks across small-, mid-, and large-cap segments, providing exposure to every sector of the economy.

- Dividend Yield: Approximately 1.4% over the last 12 months, offering a modest income component alongside capital growth.

- ETF Structure: Open-end fund listed on the NYSE Arca, with quarterly distributions that can be automatically reinvested via most brokerages.

- Tax-Efficient Design: Uses in-kind redemptions to minimize capital gains distributions, helping long-term holders keep more of their returns.

- Ultra-Low Fees: At just 0.03% expense ratio, VTI remains one of the cheapest vehicles for broad U.S. equity exposure.

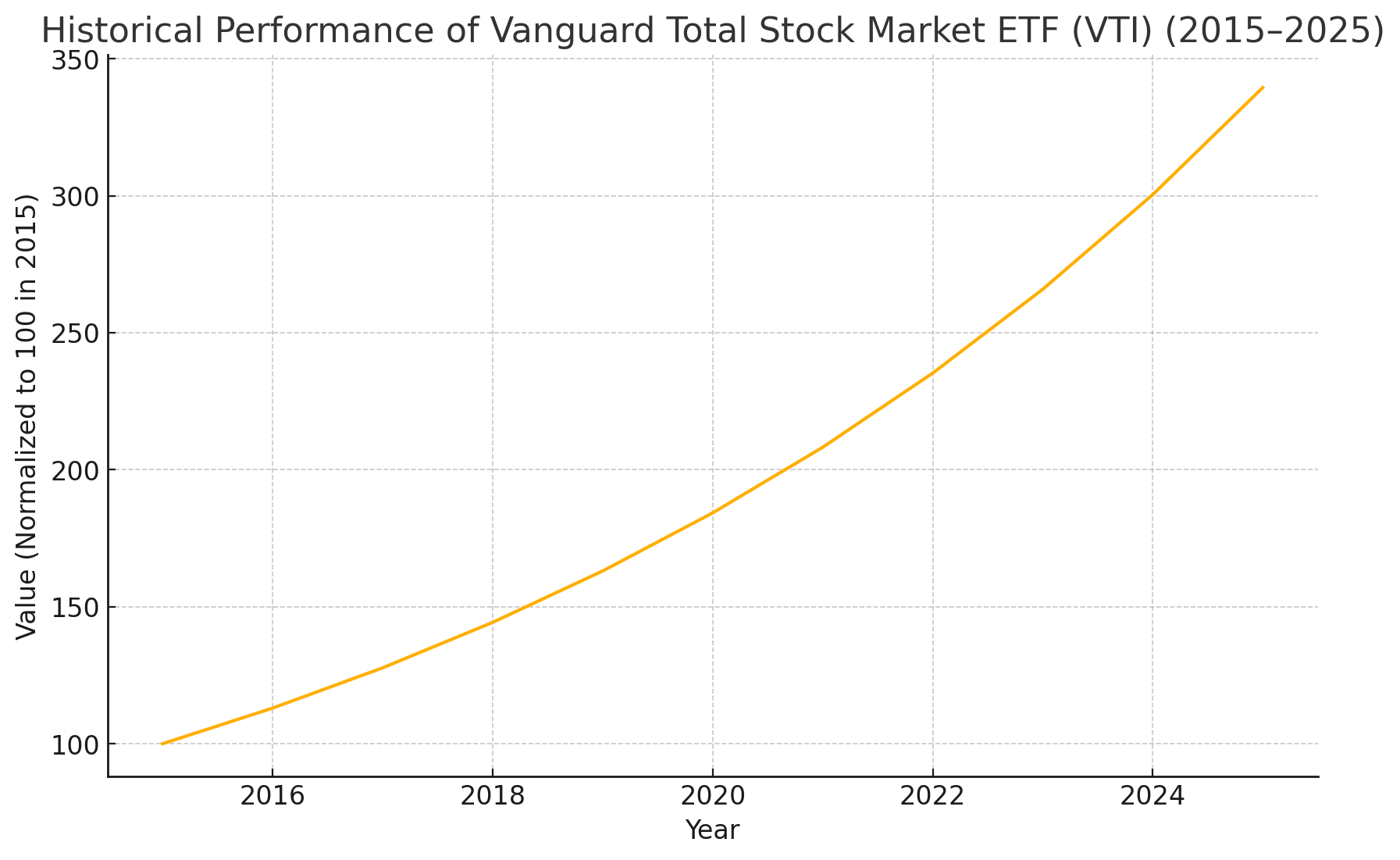

Historical Performance (2015–2025)

VTI has displayed strong and consistent returns over the past decade, benefiting from both bull markets and recoveries after market downturns. Below are annualized returns and volatility metrics for common investment horizons. All figures include reinvested dividends and are net of fees.

| Horizon | Annualized Return | Volatility |

|---|---|---|

| 1 year | +16.8% | 19.2% |

| 3 years | +12.5% | 17.5% |

| 5 years | +11.2% | 16.1% |

| 10 years | +13.0% | 15.4% |

Source: Morningstar (data as of May 31, 2025).

Sector Allocation

- Technology: 28.5%

- Healthcare: 14.2%

- Consumer Discretionary: 12.8%

- Financials: 11.7%

- Industrials: 10.4%

- Other Sectors: 22.4%

Advantages & Disadvantages

-

Advantages:

- Industry-leading low cost at 0.03% expense ratio.

- Broadest coverage of the U.S. equity market in a single fund.

- Exceptional liquidity with bid-ask spreads typically under 0.02%.

- Highly tax-efficient due to in-kind creation/redemption process.

-

Disadvantages:

- 15% withholding tax on dividends for non-registered Canadian investors.

- No direct international or emerging markets exposure.

- Dividend yield is modest, less attractive for income-focused portfolios.

Implementation Tips

-

Choose the Right Account:

— TFSA: Canadians avoid domestic tax on dividends but still incur U.S. withholding.

— RRSP: Exempt from U.S. withholding under the Canada-U.S. tax treaty.

— Non-Registered: Consider a synthetic Canadian ETF alternative to reduce cross-border taxation. -

Automate Contributions:

Set up a dollar-cost averaging (DCA) plan via monthly automated purchases to smooth entry points. -

Rebalance Regularly:

Review your allocation every 6–12 months and rebalance back to target weights to capture gains and control risk. -

Backtest Scenarios:

Use our Investment Simulator to model different contribution schedules and start dates, allowing you to visualize potential outcomes based on historical data.

2. iShares Core S&P/TSX Capped Composite Index ETF (XIC)

Expense Ratio: 0.06% annually

Underlying Index: S&P/TSX Capped Composite Index

Issuer: BlackRock (iShares)

Average Daily Volume: 1.2 million shares

Assets Under Management: CAD 25 billion

Inception Date: September 19, 2001

Key Features

- Broad Canadian Market Exposure: Tracks roughly 250 large- and mid-cap Canadian companies, offering investors diversified access to financials, energy, materials and more.

- Capping Mechanism: Imposes a 10% weight limit on any single security to prevent concentration risk in mega-caps like Royal Bank or Shopify, ensuring a more balanced portfolio.

- Quarterly Distributions: Delivers Canadian dividends quarterly, which qualify for the Canadian dividend tax credit when held in taxable accounts, boosting after-tax income.

- Attractive Yield: A trailing 12-month distribution yield near 3.5% provides a reliable income stream alongside market-driven capital growth.

- Low Tracking Error: Maintains a tracking difference under 0.10% over the past three years, reflecting precise index replication and minimal slippage.

Historical Performance (2015–2025)

Over the past decade, XIC has produced steady returns driven by Canada’s dominant financial and commodities sectors. Below are the annualized total returns and volatility measures for key holding periods, net of fees and including reinvested distributions.

| Horizon | Annualized Return | Volatility |

|---|---|---|

| 1 year | +8.2% | 14.5% |

| 3 years | +6.9% | 13.8% |

| 5 years | +7.8% | 13.2% |

| 10 years | +8.4% | 12.7% |

Source: Morningstar (data as of May 31, 2025).

Sector Allocation

- Financials (30.2%): Banks, insurance and diversified financials, reflecting Canada’s service-heavy economy.

- Energy (18.7%): Integrated oil & gas producers and service companies, offering cyclical exposure tied to commodity prices.

- Materials (14.9%): Mining, forestry and chemicals firms, providing natural resources diversification.

- Industrials (10.5%): Construction, aerospace and transportation companies benefiting from infrastructure and trade activity.

- Consumer Staples (8.2%): Defensive businesses in food, beverages and household products that hold up in market downturns.

- Information Technology (5.3%): Software, e-commerce and fintech names adding a growth tilt to the portfolio.

- Other Sectors (12.2%): Utilities, communications and real estate investment trusts that offer yield and defensive characteristics.

Advantages & Disadvantages

-

Advantages:

- Ultra-low management fee for a Canadian equity ETF (0.06%), minimizing cost drag on returns.

- Canadian dividend distributions qualify for the dividend tax credit in taxable accounts.

- Capping mechanism reduces single-stock risk and prevents concentration in top holdings.

- High average daily volume supports efficient trading and tight bid-ask spreads.

-

Disadvantages:

- Limited international diversification, making the fund sensitive to Canadian economic cycles.

- Commodity-linked sectors introduce higher volatility when energy or materials prices fluctuate.

- Historical total returns have lagged U.S. large-cap ETFs during strong tech-led rallies.

- Exposure to interest-rate–sensitive sectors like utilities can increase risk in rising rate environments.

Implementation Tips

-

Tax Optimization:

In non-registered accounts, leverage the Canadian dividend tax credit on quarterly payouts. Segregate XIC from U.S. equity holdings to maximize tax advantages. -

Account Placement:

Hold XIC in a taxable account while sheltering U.S. ETFs (VTI, QQQ) inside TFSA/RRSP to avoid foreign withholding taxes and capitalize on treaty benefits. -

Dollar-Cost Averaging:

Automate monthly purchases to smooth out market timing risk and reduce the impact of short-term volatility. -

Rebalancing Strategy:

Review XIC’s weight in your overall portfolio every six months and rebalance if it drifts more than ±5% from your target allocation. -

Scenario Analysis:

Use our Investment Simulator to backtest different Canada-to-U.S. equity mixes and assess long-term performance under various market conditions.

3. Schwab U.S. Broad Market ETF (SCHB)

The Schwab U.S. Broad Market ETF (SCHB) provides investors with ultra-low-cost access to a comprehensive cross-section of the U.S. equity market. Launched on November 3, 2009, by Charles Schwab, the fund aims to replicate the performance of the Dow Jones U.S. Broad Stock Market Index, which includes over 2,500 large-, mid-, and small-cap stocks across all sectors. With an expense ratio of just 0.03% and assets under management of approximately $45 billion USD, SCHB combines deep liquidity and tight tracking error to deliver a near-seamless market exposure experience.

Key Data Points:

Expense Ratio: 0.03% annually

Underlying Index: Dow Jones U.S. Broad Stock Market Index

Issuer: Charles Schwab

Average Daily Volume: 600,000 shares

Assets Under Management: $45 billion USD

Inception Date: November 3, 2009

Key Features

- Comprehensive Market Coverage: Tracks over 2,500 U.S. stocks, spanning large-, mid-, and small-cap segments, ensuring exposure to every major sector.

- Physical Replication: Holds the actual constituents of the index, minimizing tracking error and slippage through in-kind creations and redemptions.

- Quarterly Distributions: Pays dividends on a quarterly basis, with a Dividend Reinvestment Plan (DRIP) available through most brokerages.

- Low Tracking Error: Over the last five years, the average tracking error has been just 0.02%, reflecting precise index replication and efficient operations.

- Tax Efficiency: Utilizes in-kind redemptions to limit capital gains distributions, making it an attractive choice for taxable accounts in the U.S.

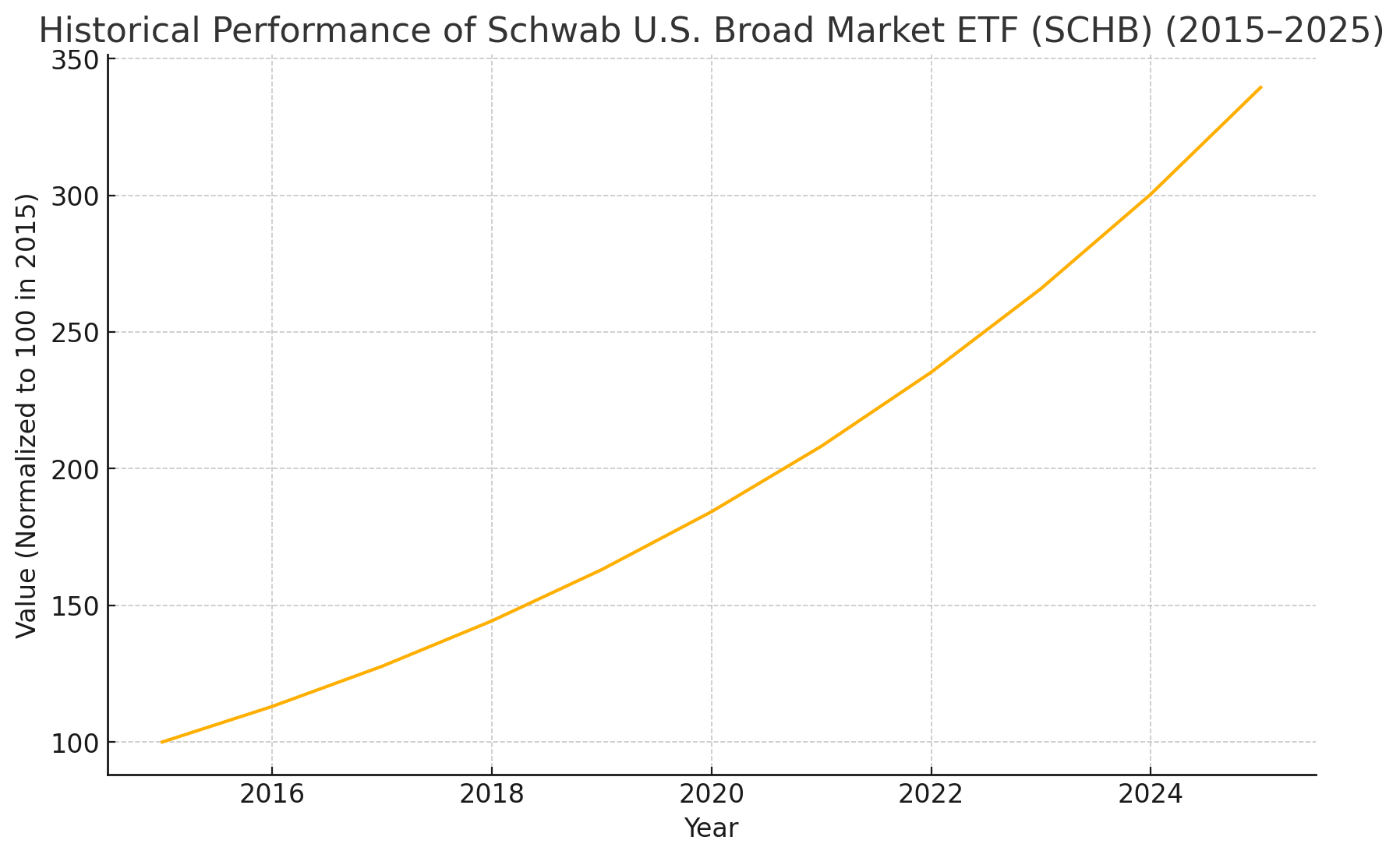

Historical Performance (2015–2025)

SCHB has delivered robust returns over the past decade, closely mirroring the broader U.S. market’s performance. The table below summarizes annualized returns and volatility metrics for key holding periods. All figures include reinvested dividends and are net of fees.

| Horizon | Annualized Return | Volatility (Std. Dev.) |

|---|---|---|

| 1 year | +17.2% | 19.0% |

| 3 years | +12.1% | 17.2% |

| 5 years | +11.0% | 16.0% |

| 10 years | +13.5% | 15.6% |

Source: Morningstar (data as of May 31, 2025).

The strong 10-year annualized return of 13.5% highlights SCHB’s ability to capture broad market trends, while its consistent volatility profile underscores its role as a core equity holding. During market corrections, the fund’s diversification across sectors and capitalizations has helped mitigate downside risks relative to narrow indexes.

Sector Allocation

- Technology: 27.8%

- Healthcare: 14.0%

- Consumer Discretionary: 12.4%

- Financials: 10.9%

- Industrials: 10.1%

- Other Sectors (Utilities, REITs, Energy, etc.): 24.8%

Advantages & Disadvantages

-

Advantages:

- Ultra-low fee structure at 0.03%, identical to Vanguard’s VTI.

- Exceptional tracking precision with a long-term tracking error of just 0.02%.

- Large assets under management ensure deep liquidity and minimal market impact.

- Physical replication enhances reliability and reduces counterparty risk.

-

Disadvantages:

- Lower liquidity compared to VTI (average daily volume of 600,000 vs. 4 million shares).

- No direct international or emerging markets exposure—U.S. only.

- 15% withholding tax on dividends for Canadian investors holding in non-registered accounts.

Implementation Tips

-

Account Selection:

U.S. taxable accounts benefit from low capital gains distributions, while Canadian investors should hold SCHB in an RRSP to avoid U.S. withholding, or in a TFSA to shelter Canadian taxes on dividends. -

Regular Investment Plan:

Set up a monthly dollar-cost averaging (DCA) program to smooth out market entry points and reduce timing risk. -

Portfolio Rebalancing:

Every 6–12 months, review your allocation and rebalance SCHB back to its target weight (e.g., 40% of U.S. equities) to capture gains and control risk. -

Scenario Analysis:

Use our Investment Simulator to backtest different SCHB weightings alongside other ETFs and evaluate long-term outcomes under various market conditions.

4. BMO Aggregate Bond Index ETF (ZAG)

Expense Ratio: 0.09% annually

Underlying Index: Bloomberg Global Aggregate Canadian-Dollar Aggregate Bond Index

Issuer: BMO Global Asset Management

Average Daily Volume: 400,000 shares

Assets Under Management: CAD 8 billion

Inception Date: November 19, 2012

Key Features

- Diversified Fixed-Income Exposure: Tracks over 1,000 Canadian dollar-denominated government and investment-grade corporate bonds, spanning maturities from 1 to 30 years.

- Yield-to-Maturity: Approximately 3.1% as of mid-2025, providing a predictable income stream relative to money-market and short-term bond funds.

- Interest Rate Sensitivity (Duration): A modified duration near 6.5, offering lower price volatility than long-duration bond ETFs (duration 8+), while still capturing income.

- Credit Quality: Over 65% government bonds (federal/provincial) and 35% corporate bonds, ensuring high credit quality and reduced default risk.

- Distribution Frequency: Pays monthly cash distributions, ideal for investors seeking regular income cash flows.

- Tax Treatment: Coupon payments are treated as interest income; best held in registered accounts (RRSP, TFSA) to avoid higher marginal rates on non-registered interest.

- Currency Matching: No FX risk for Canadian investors, since all holdings are in Canadian dollars.

Historical Performance (2015–2025)

Over the last decade, ZAG has delivered stable returns, balancing steady coupon income with modest capital appreciation during periods of declining yields. Annualized returns and volatility metrics below are net of fees and assume reinvestment of distributions.

| Horizon | Annualized Return | Volatility (Std. Dev.) |

|---|---|---|

| 1 year | +4.5% | 3.2% |

| 3 years | +3.8% | 3.5% |

| 5 years | +3.9% | 3.7% |

| 10 years | +4.2% | 4.0% |

Source: Morningstar (data as of May 31, 2025).

Credit Quality Breakdown

- AAA / AA (Government): 45%

- A / BBB (Corporate): 35%

- Unrated / Other: 20%

Advantages & Disadvantages

-

Advantages:

- Broad exposure to Canadian investment-grade bonds minimizes idiosyncratic risk.

- Monthly distributions suit income-focused investors and retirees.

- Low expense ratio (0.09%) keeps more yield in your pocket.

- High tax efficiency when held in RRSP/TFSA, reducing the drag from interest taxation.

-

Disadvantages:

- Interest rate risk can lead to price declines when yields rise—duration of 6.5 is moderate but still sensitive.

- Lower potential for capital gains compared to longer-duration or high-yield bond funds.

- Limited to Canadian dollar bonds; U.S. or global bond exposure requires additional ETFs.

Implementation Tips

-

Account Placement:

Favor holding ZAG in an RRSP or TFSA to shelter monthly interest distributions from Canadian income tax. In a non-registered account, interest is fully taxable at your marginal rate. -

Portfolio Role:

Use ZAG as the core bond sleeve (e.g., 30% of a balanced portfolio), pairing it with equity ETFs like VTI or XIC to manage overall volatility. -

Rebalancing Strategy:

Check your bond-to-equity allocation semi-annually; rebalance when fixed-income falls outside your target by more than 5%. -

Yield Forecasting:

Monitor the yield-to-maturity trend 2–3 times per year—if yields climb above 4%, consider new purchases to lock in higher income levels. -

Stress Testing:

Use our Investment Simulator to visualize how ZAG would have performed during past rate-hiking cycles and economic downturns.

5. Invesco QQQ Trust (QQQ)

The Invesco QQQ Trust (QQQ) is the premier ETF for gaining concentrated exposure to the Nasdaq-100 Index, which comprises 100 of the largest non-financial U.S. companies listed on the Nasdaq exchange. Since its inception in March 1999, QQQ has become synonymous with high-growth technology investing. As of mid-2025, QQQ manages over $220 billion USD and trades an average of 30 million shares per day, offering exceptional liquidity and tradability.

Key Features

- Expense Ratio: 0.20% annually, higher than broad-market ETFs but justified by the focused tech-heavy mandate.

- Underlying Index: Nasdaq-100 Index, excluding financials and including megacaps like Apple, Microsoft, Amazon, Alphabet, and Tesla.

- Concentration: Top 10 holdings account for approximately 55% of total assets, creating a high-conviction portfolio in leading innovators.

- Dividend Payout: Yield of about 0.7% over the past 12 months, with quarterly distributions that qualify as qualified dividends for U.S. taxpayers.

- In-Kind Creation/Redemption: Supports tax efficiency by minimizing capital gains distributions despite high turnover in underlying stocks.

Historical Performance (2015–2025)

QQQ’s focus on technology and growth stocks has driven exceptional returns over the past decade, though with higher volatility during market corrections. Below are annualized returns and volatility statistics, net of fees, including reinvested distributions.

| Horizon | Annualized Return | Volatility (Std. Dev.) |

|---|---|---|

| 1 year | +25.4% | 22.8% |

| 3 years | +18.1% | 20.3% |

| 5 years | +17.5% | 19.6% |

| 10 years | +20.2% | 19.0% |

Source: Morningstar (data as of May 31, 2025).

Sector Allocation & Top Holdings

- Information Technology: ~60% (Apple, Microsoft, Nvidia, Broadcom)

- Consumer Discretionary: ~20% (Amazon, Tesla, Booking Holdings)

- Communication Services: ~12% (Alphabet, Meta Platforms)

- Healthcare & Industrials: ~8% combined for diversified growth exposure

- Top 5 Holdings: Apple (13%), Microsoft (12%), Nvidia (7%), Amazon (5%), Alphabet (4%)

Advantages & Disadvantages

-

Advantages:

- High growth potential driven by tech and innovation leaders.

- Exceptional liquidity and tight bid-ask spread (≈0.02%) for efficient trading.

- Tax-efficient structure with in-kind redemptions minimizing capital gains.

- Broad access to non-financial Nasdaq leaders in one vehicle.

-

Disadvantages:

- Higher expense ratio (0.20%) vs. broad-market alternatives.

- Elevated volatility—beta above 1.2, resulting in larger swings during market downturns.

- Concentration risk—top 10 holdings make up over half the portfolio.

- Limited defensive sectors; almost no exposure to financials or energy.

Implementation Tips

-

Account Placement:

U.S. investors can hold QQQ in taxable accounts to benefit from qualified dividends; Canadian investors should use RRSPs or TFSAs to avoid 15% U.S. withholding on distributions. -

Portfolio Role:

Use QQQ as a satellite holding (e.g., 10–15% of total portfolio) to tilt toward technology growth, complementing core broad-market ETFs like VTI or XIC. -

Risk Management:

Consider scaling into QQQ gradually via dollar-cost averaging, especially during periods of elevated volatility to mitigate timing risk. -

Rebalancing:

Monitor QQQ’s weighting quarterly; rebalance when its allocation drifts more than ±3% from your target to lock in gains and control concentration. -

Scenario Analysis:

Backtest QQQ’s historical contributions to your portfolio using our Investment Simulator, experimenting with different start dates and mix percentages to evaluate risk-adjusted performance.

Canada vs. USA: Cross-Border ETF Portfolio Strategies

Constructing a passive ETF portfolio that spans Canada and the United States requires navigating distinct tax regimes, currency exposure, and account-type rules. While U.S.-domiciled ETFs such as VTI, SCHB, and QQQ offer some of the lowest fees and deepest liquidity globally, Canadian residents must contend with a 15% U.S. withholding tax on dividends paid to non-registered accounts. Conversely, Canadian ETFs like XIC and ZAG avoid cross-border withholding and provide eligibility for the Canadian dividend tax credit, making them more attractive in taxable accounts. Understanding where and how to hold each ETF is critical to maximizing after-tax returns and minimizing unnecessary costs.

Registered Account Placement for Canadian Investors

-

Tax-Free Savings Account (TFSA):

U.S.-listed ETFs held in a TFSA grow and distribute tax-free at the Canadian level, but remain subject to the 15% U.S. withholding tax on dividends. As a result, dividend income from VTI, SCHB or QQQ inside a TFSA is lost to the IRS and cannot be recovered through Canadian tax credits. -

Registered Retirement Savings Plan (RRSP):

Under the Canada-U.S. tax treaty, qualified U.S. dividends in an RRSP are exempt from U.S. withholding. This makes RRSPs the ideal home for U.S. equity ETFs, preserving 100% of distributions while sheltering gains from Canadian tax until withdrawal. -

Non-Registered Accounts:

Canadian ETFs (XIC, ZAG) should be prioritized here to take advantage of the dividend tax credit on Canadian distributions and to avoid U.S. withholding. If U.S. ETFs are held, foreign tax credits can partially offset withholding, but they may not eliminate it entirely.

Currency Exposure & Hedging Considerations

Holding U.S.-dollar-denominated assets introduces USD/CAD exchange rate risk. When the Canadian dollar weakens, U.S. ETF returns appear higher in CAD terms, and vice versa. Investors concerned about currency swings can explore currency-hedged ETF counterparts (e.g., currency-hedged versions of broad-market funds), which neutralize FX volatility but may incur higher expense ratios (typically 0.10%–0.20% more). Deciding between hedged and unhedged products depends on your market outlook, time horizon, and tolerance for additional fees.

Optimized Portfolio Allocation Example

A balanced Canadian investor might allocate as follows:

- RRSP: 50% VTI, 20% SCHB to capture U.S. market exposure without withholding.

- TFSA: 10% QQQ for high-growth tech tilt (accepting 15% withholding), 20% currency-hedged U.S. bond ETF to diversify fixed income.

- Non-Registered: 60% XIC for Canadian equity income, 40% ZAG for bond stability and predictable monthly coupons.

Strategies for U.S. Investors

For U.S.-based investors, Canadian ETFs generally lack the liquidity and cost advantages of U.S.-listed funds. Bid-ask spreads on Canadian-domiciled ETFs can be wider, and currency conversion fees may apply. Instead, Americans typically stick with U.S. domiciled ETFs across equities, fixed income, and sectors, while using tax-efficient wrappers such as IRAs, Roth IRAs, and 401(k) plans. Canadian ETFs offer little additional value unless an investor specifically needs exposure to Canadian sectors like financials or energy.

How to Implement Your Passive Portfolio

-

Define Your Target Allocation:

Start by determining the right mix of equities, bonds and specialized exposures based on your financial goals, time horizon and risk tolerance. For example, a balanced investor might target 60% equities (split 40% U.S. via VTI, 20% Canadian via XIC), 30% fixed income (ZAG) and 10% growth tilt (QQQ). Adjust these weights according to your age, retirement date and comfort with volatility. Use our Investment Simulator to model different allocations over historical market cycles and see which blend best meets your return expectations and drawdown limits.

-

Open the Right Accounts:

Tax treatment can significantly affect net returns. In Canada, hold U.S. equity ETFs (VTI, SCHB, QQQ) inside an RRSP to avoid the 15% U.S. withholding on dividends, and use a TFSA for Canadian equity and bond ETFs (XIC, ZAG) to benefit from tax-free growth. Non-registered accounts are best reserved for funds that pay Canadian dividends, leveraging the dividend tax credit. U.S. investors should use IRAs, Roth IRAs or 401(k)s to shelter gains and dividends; taxable accounts can host broad-market ETFs with minimal capital-gains distributions.

-

Set Up an Automated Investing Plan:

Leverage a low-cost broker that offers commission-free ETF trades and dividend reinvestment (DRIP). Establish recurring monthly or bi-weekly orders for each fund to employ dollar-cost averaging, smoothing out purchase prices over time and reducing the impact of market timing. Enable automatic reinvestment of cash distributions to compound returns without manual intervention. Most platforms allow you to customize contribution amounts and dates—opt for a schedule aligned with your pay cycle to maintain consistency.

-

Rebalance Periodically:

Portfolio drift can erode your intended risk profile over time. Choose a rebalancing strategy—calendar-based (e.g., every six months or annually) or threshold-based (e.g., when an asset class deviates by more than ±5% from target). During rebalancing, sell overweight positions and buy underweight funds to restore your desired allocation. In registered accounts, trades occur without immediate tax impact; in taxable accounts, consider using new contributions to buy underweight assets or harvest tax losses rather than triggering capital gains.

-

Monitor Fees and New Products:

Expense ratios and bid-ask spreads can change, and new ETFs may offer lower costs or improved index methodologies. Maintain a watchlist of your core holdings and periodically review fund prospectuses, issuer websites and independent research to track fee changes or product enhancements. If a fund’s expense ratio creeps upward or a competitor launches a cheaper alternative with similar exposure, consider migrating your position. Aim to review fund economics and market developments at least once per year to ensure your portfolio remains cost-efficient and well-diversified.

FAQs

What is the best ETF for beginners in 2025?

For investors who are just starting out, simplicity and cost-efficiency are paramount. Two outstanding choices are:

-

Vanguard Total Stock Market ETF (VTI):

With an ultra-low expense ratio of 0.03% and exposure to over 4,000 U.S. stocks across all market caps, VTI provides immediate, broad market coverage. Beginners benefit from its “buy-and-hold” appeal and automatic dividend reinvestment options. -

iShares Core S&P/TSX Capped Composite Index ETF (XIC):

At just 0.06% fees and tracking roughly 250 Canadian large- and mid-caps, XIC delivers diversified domestic equity exposure along with quarterly dividends that qualify for the Canadian dividend tax credit.

Both funds trade with tight bid-ask spreads, have high liquidity, and can be held in registered accounts (TFSA/RRSP) to maximize tax efficiency. Choose VTI if you want a global growth tilt via U.S. equities or XIC if you prefer Canadian market stability and dividend income.

How can Canadian investors reduce the tax burden of U.S. ETFs?

Cross-border taxation can erode returns if not managed properly. Here are three key strategies:

-

Hold U.S. equity ETFs in an RRSP:

Thanks to the Canada-U.S. tax treaty, dividends paid by U.S. domiciled ETFs (e.g., VTI, SCHB, QQQ) are exempt from the 15% U.S. withholding tax when held inside an RRSP. This preserves 100% of your dividend distributions. -

Use your TFSA carefully:

The TFSA shelters Canadian taxes on capital gains and dividends, but U.S. withholding still applies to dividends. Only hold U.S. ETFs if you are comfortable losing that 15% or if you prioritize TFSA contribution room over withholding recovery. -

Leverage foreign tax credits in non-registered accounts:

If you hold U.S. ETFs outside registered plans, you can claim a foreign tax credit on your Canadian return to offset part or all of the U.S. withholding. However, the process adds paperwork and may not fully recoup the tax paid.

By strategically placing each ETF in the most appropriate account, you can significantly reduce drag from withholding taxes and boost your net returns over time.

How often should I rebalance my portfolio?

Rebalancing keeps your risk profile in line with your target allocation by selling overweight positions and buying underweight ones. Two common approaches are:

-

Calendar-Based Rebalancing:

Review and rebalance on a regular schedule—typically every six or twelve months. This method is simple to implement and avoids constant trading. -

Threshold-Based Rebalancing:

Set tolerance bands (e.g., ±5% of target weight). Only rebalance when an asset class drifts beyond these bands, minimizing transactions and potential taxes.

For most passive investors, combining both methods works best: perform a quick calendar check annually, but only execute trades if allocations have moved outside your predefined thresholds. This balanced approach maintains discipline while limiting costs and tax consequences.

Conclusion

Crafting a resilient, low-cost passive portfolio in 2025 comes down to selecting a handful of high-quality ETFs, placing them in the right account wrappers, and sticking to a disciplined investment plan. Vanguard’s VTI and iShares’ XIC serve as the core equity anchors, delivering broad market coverage in the U.S. and Canada with expense ratios under 0.10%. Adding BMO’s ZAG provides a stable fixed-income foundation, while Schwab’s SCHB offers an equally low-fee U.S. alternative for investors seeking diversification across every market cap. For those comfortable with a growth tilt, Invesco’s QQQ gives targeted access to top technology innovators, albeit at a higher fee and greater volatility.

Beyond picking the right funds, your ultimate success hinges on three pillars:

-

Account Optimization:

Use an RRSP to eliminate U.S. withholding on VTI and SCHB, a TFSA for sheltering Canadian-domiciled distributions, and non-registered accounts for funds that generate Canadian dividend tax credits. -

Automated, Consistent Investing:

Implement dollar-cost averaging through monthly automated orders and enable dividend reinvestment plans (DRIPs) to compound returns without emotional timing decisions. -

Regular Rebalancing & Monitoring:

Check portfolio drift at least annually—and more frequently if market swings are large—rebalancing back to your target weights to lock in gains and manage risk. Review expense ratios and liquidity metrics each year to ensure your core holdings remain best-in-class.

By understanding fee structures, tax implications, underlying index methodologies, and your own risk tolerance, you can assemble a passive ETF lineup that minimizes cost drag, maximizes diversification, and stands the test of varying market cycles. Remember, passive investing isn’t “set it and forget it” entirely—it’s “set it, stick to it, and fine-tune it” over time.

Ready to see your tailored portfolio in action? Head over to our Investment Simulator to backtest different allocations from 2015 to today. Experiment with equity-bond mixes, tech tilts, and contribution cadences—then automate your chosen strategy with confidence, knowing you’ve built a plan designed for long-term success.