How to Start Investing With $50 a Month (Beginner Guide) 💰

Introduction

Embarking on an investment journey can feel overwhelming, especially when you’re starting with modest means. You might think that investing requires large sums of capital or insider knowledge—but in reality, consistently investing a small amount, like $50 per month, can unlock the powerful forces of dollar-cost averaging and compound growth. Over time, these strategies help smooth out market volatility and amplify returns, turning modest, regular contributions into substantial long-term wealth.

This beginner’s guide is designed to demystify the process, breaking it down into clear, actionable steps. We’ll begin by helping you define realistic financial goals—whether that’s building an emergency fund, saving for a home down payment, or laying the groundwork for retirement. From there, we’ll explore how to choose the right investment accounts—such as tax-advantaged retirement vehicles or flexible taxable brokerages—to maximize your tax efficiency and liquidity.

Next, we’ll dive into selecting the optimal investment vehicles for a $50-per-month plan. You’ll learn why low-cost index funds and ETFs often make the most sense for small, regular contributions, and how to use fractional shares to ensure every dollar is put to work. We’ll also discuss how to manage fees effectively so that a tiny expense ratio doesn’t erode your early gains.

To keep your plan on track, automation is key. We’ll show you how to set up recurring transfers so your investments happen “set and forget,” reducing the temptation to skip contributions during market downturns. Plus, you’ll discover how to schedule periodic portfolio reviews to monitor performance and rebalance when asset allocations drift.

Along the way, you’ll find interactive tools to reinforce these lessons: experiment with our free investment simulator to model different market scenarios and contribution frequencies, and plug your details into our DCA calculator to generate a personalized dollar-cost averaging plan. These resources help you visualize how your $50 a month can grow over time and adapt your strategy as your goals evolve.

By the end of this guide, you’ll have a complete roadmap—from goal setting and account selection to investment choices and automated execution—empowering you to take control of your financial future. No jargon, no fluff: just step-by-step guidance you can implement today, even if you’re starting from zero. Ready to turn your $50 into a powerful wealth-building habit? Let’s dive in.

Why Invest $50 a Month?

For many aspiring investors, the idea of needing thousands of dollars to begin is a psychological barrier that prevents action. In truth, a modest commitment of $50 per month—roughly the cost of two lattes—can harness the power of the markets and compound interest to build significant wealth over time. By investing $600 annually, you lay the foundation for long-term growth without overstretching your budget.

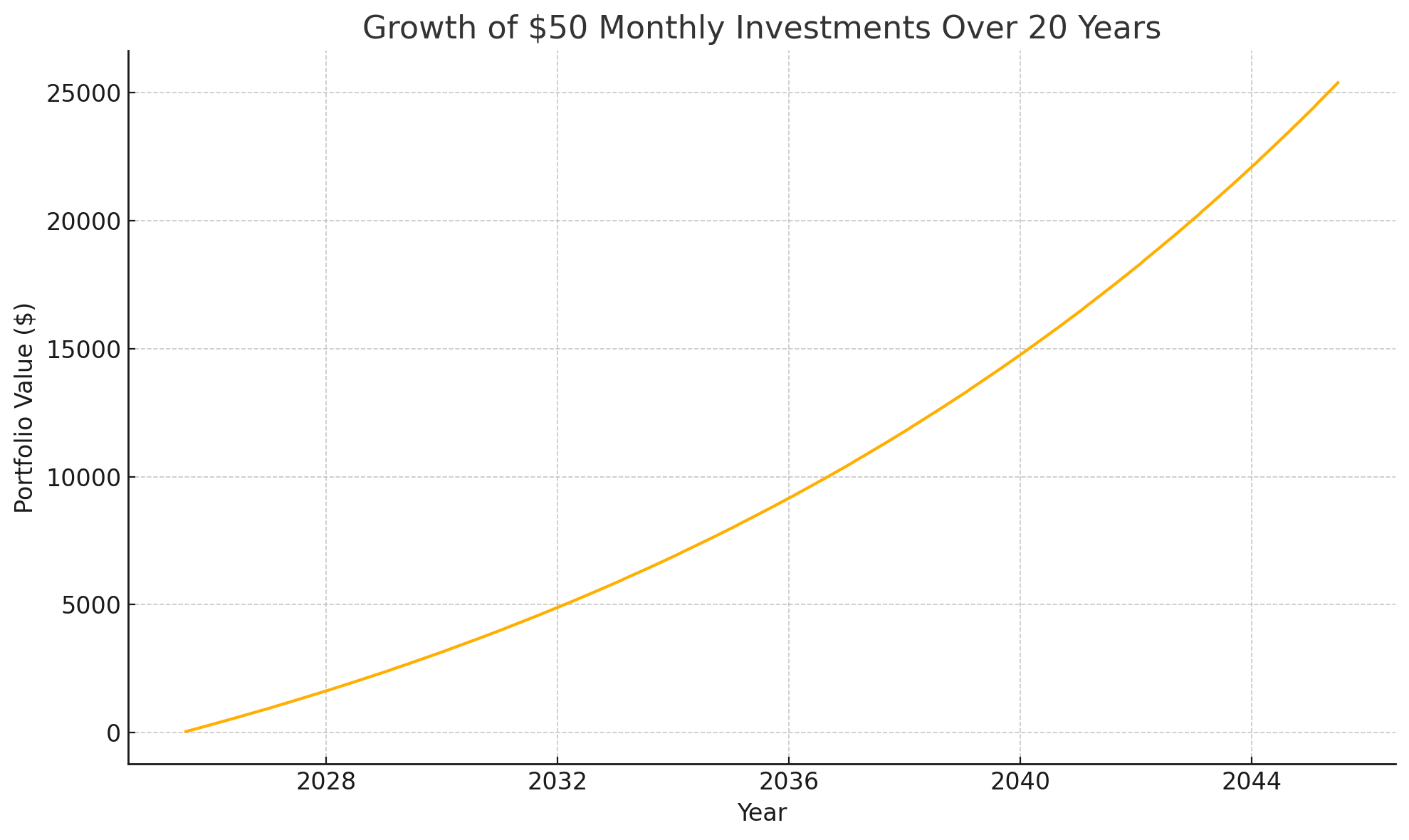

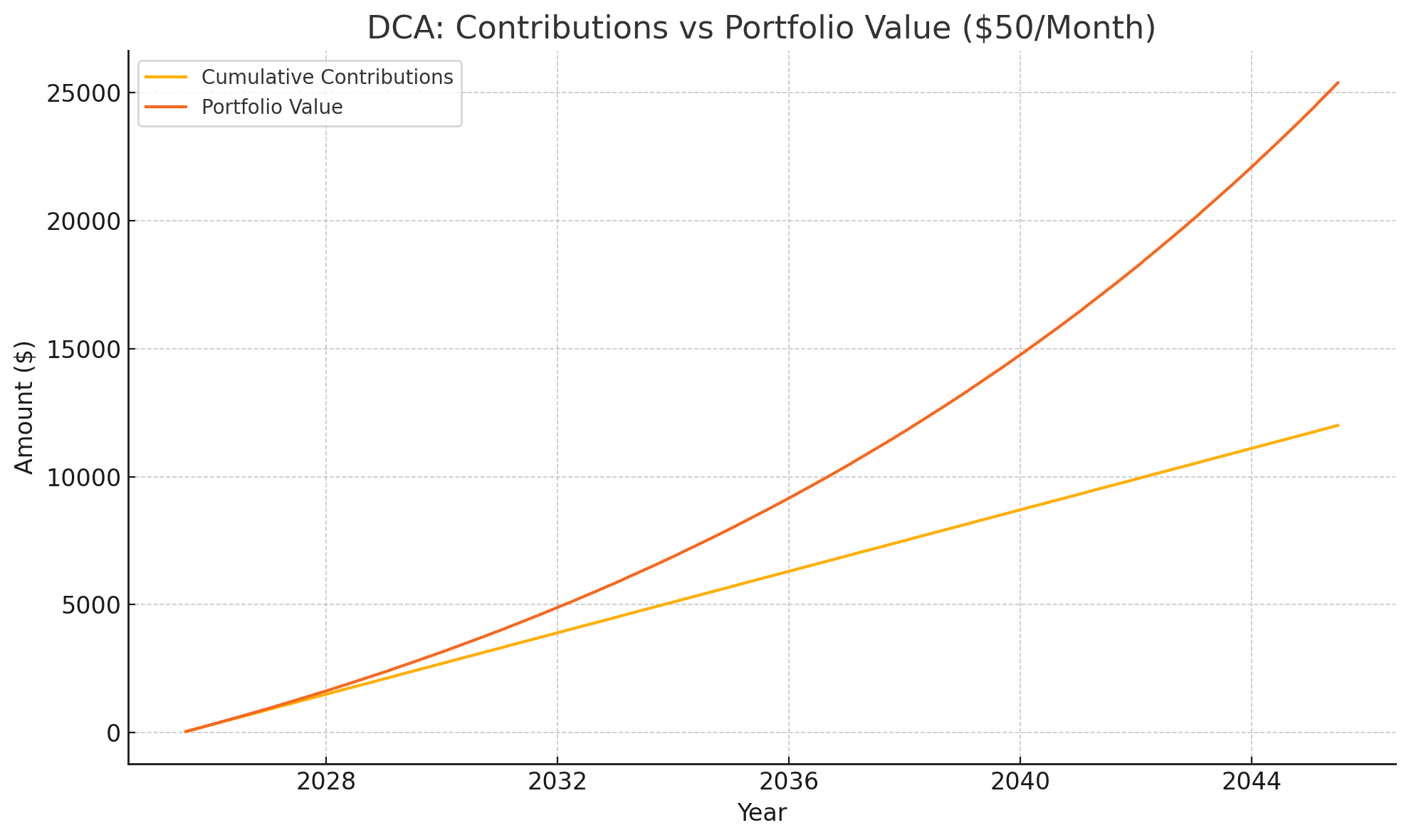

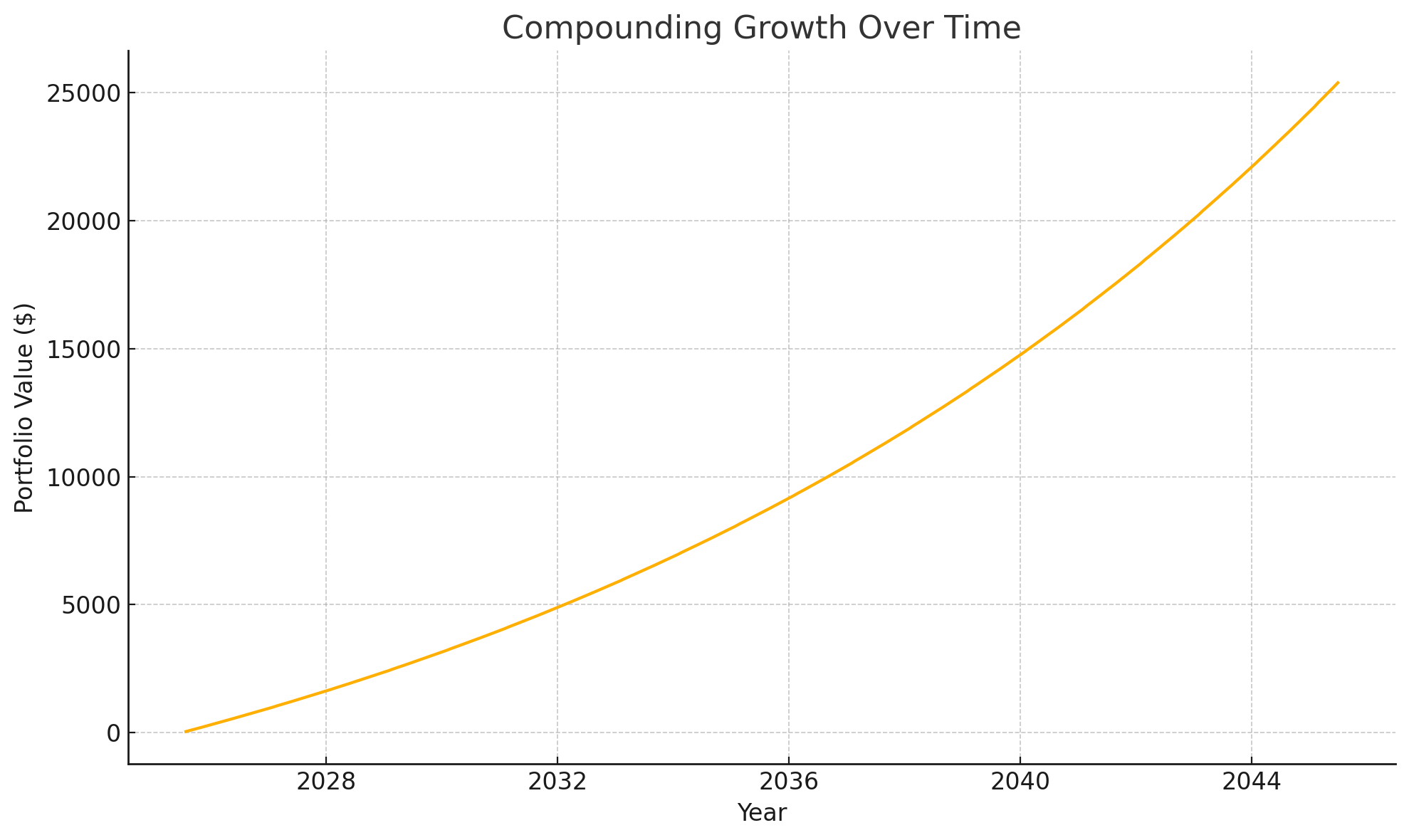

Let’s put numbers to the concept: with a conservative 7% average annual return, your $6,000 of contributions over 10 years could grow to around $9,300. Extend the horizon to 20 years, and that same $600 per year converts into over $24,000—quadrupling your principal. These illustrative figures demonstrate how even small, steady investments benefit exponentially from compound growth, where each year’s earnings generate additional earnings.

Beyond the math, committing to $50 monthly instills a vital habit: disciplined saving. Consistency trumps timing, and regular contributions smooth out market volatility, buying more shares when prices dip and fewer when they rise. This dollar-cost averaging approach minimizes regret and emotional decision-making, guiding you away from reactive buying or panic selling.

Unsure if $50 per month fits your personal budget or goals? Experiment with our investment simulator to model different contribution levels, asset allocations, and time horizons. Adjust inputs to see how small increases—or decreases—affect your projected balance. By visualizing outcomes, you’ll gain confidence in selecting a sustainable amount you can stick to through market upturns and downturns.

Finally, remember that starting is the hardest part. Even if you can only begin with $25 or $100 per month, the key is to start somewhere and build momentum. As your income grows or expenses shift, you can gradually increase contributions. Over decades, that compounding habit becomes a powerful engine for reaching life milestones—whether that’s buying a home, funding education, or retiring comfortably.

Setting Your Financial Goals

Establishing clear financial goals is the foundation of any successful investing journey. Begin by asking yourself what you want to achieve: Do you aim to build an emergency fund to cover 3–6 months of living expenses? Are you saving for a down payment on a home within the next five years? Or is your primary objective long-term growth for retirement? By articulating specific, measurable targets—often referred to as SMART goals (Specific, Measurable, Achievable, Relevant, Time-bound)—you can tailor your investment strategy and avoid drifting off course.

Next, categorize your objectives by time horizon:

- Short-term (1–3 years): Goals like an emergency fund or a vacation. Prioritize liquidity and capital preservation—consider high-yield savings or short-term bond funds.

- Medium-term (3–10 years): Goals such as buying a car or making a down payment. Allocate to a mix of bonds and equities for moderate growth with lower volatility.

- Long-term (10+ years): Retirement, children’s education, or legacy wealth. Opt for equity-heavy portfolios (e.g., Total Market ETFs) to maximize compound growth over decades.

With these categories in place, decide how to distribute your $50 monthly contribution. For example, you might allocate $20 to a high-yield savings account or money market fund for your emergency buffer, $20 to a Roth IRA invested in a diversified ETF for retirement, and $10 to a taxable brokerage account for medium-term goals. This balanced approach ensures you maintain liquidity while capturing growth where it matters most.

To visualize and refine your plan, download our free goal-setting worksheet available on the WhatIfInvested blog. The interactive PDF guides you through assigning dollar amounts, setting deadlines, and tracking progress. Revisit your worksheet quarterly or after major life changes—new job, family additions, or unexpected expenses—to adjust contributions and timelines accordingly.

Finally, embed your goals into your automation routine. Use our DCA calculator to schedule splits among your chosen accounts, and track achievement milestones in your calendar. By linking contributions directly to your goals, you transform abstract targets into concrete actions—keeping you motivated and disciplined through market ups and downs.

Choosing the Right Investment Account

Selecting the appropriate account type is the first and most important step toward maximizing your returns and minimizing taxes and fees. Each account has distinct features—such as contribution limits, tax treatment, withdrawal rules, and employer benefits—that determine its suitability for your goals and time horizon. Below, we outline the most common options for beginner investors in North America.

- Roth IRA / TFSA: Contributions are made with after-tax dollars; earnings and qualified withdrawals are tax-free. Ideal for retirement savings if you expect to be in a higher tax bracket later. Annual limits are $6,500 (IRA) or C$6,500 (TFSA), and you can withdraw contributions anytime without penalty.

- Traditional IRA / RRSP: Contributions are often tax-deductible in the year made, reducing current taxable income. Growth is tax-deferred until withdrawal—typically taxed at your future rate. Good if you expect lower income in retirement, but watch for withholding taxes on early withdrawals.

- Taxable Brokerage Account: No contribution caps or early withdrawal penalties. Dividends and realized capital gains are taxed annually. Offers maximum flexibility for medium-term goals (3–10 years) and easy access to funds, but higher tax drag compared to tax-advantaged accounts.

- 401(k) / Group RRSP: Employer-sponsored plans often include matching contributions—up to 50% or more of your deferral—effectively an immediate 50% return. Contributions are pre-tax (401(k)) or tax-deductible (Group RRSP), and many plans offer automatic payroll deductions and employer-approved investment menus.

Roth IRA / TFSA considerations: If you’re a young investor in a lower tax bracket, a Roth IRA or TFSA lets you lock in tax-free growth. In Canada, TFSA contribution room accumulates each year, so unutilized space from previous years can be carried forward indefinitely. U.S. Roth IRAs impose income limits, so high earners may phase out.

Traditional IRA / RRSP considerations: Contributing to an RRSP reduces your taxable income in the current year, which can be advantageous if you anticipate lower income—and thus lower tax rates—in retirement. Unlike a Roth, withdrawals are taxed as ordinary income. RRSPs can also hold mortgage insurance and spousal plans.

Taxable Brokerage considerations: Use this account for goals with shorter horizons or when you need liquidity. To reduce tax drag, favor tax-efficient ETFs and index funds. Keep track of cost-basis and avoid frequent trading to minimize realized gains.

401(k) / Group RRSP considerations: Always contribute at least enough to capture the full employer match—this is “free money.” Be mindful of plan-specific investment options and management fees. If you change jobs, rollover options typically allow you to transfer balances into an IRA or personal RRSP.

For beginners, we recommend opening a low-cost, no-minimum brokerage that offers fractional shares—such as Wealthsimple (sign up here)—and then linking it to automate your $50 monthly contributions. Use our DCA calculator to split contributions across multiple accounts and asset classes, and run scenarios in our investment simulator. This approach ensures you capture tax advantages, maintain diversification, and keep your strategy on autopilot.

Selecting Investment Options

When you’re starting with $50 a month, buying individual stocks can be inefficient due to high share prices and lack of diversification. Instead, low-cost index funds and ETFs (exchange-traded funds) offer instant diversification across hundreds or thousands of companies for just a few dollars per trade. These funds track broad market benchmarks, reducing single-stock risk and minimizing research time—perfect for beginner investors.

- Total Market Index Fund (VTI, SCHB): Captures the performance of nearly the entire U.S. stock market, including small-, mid-, and large-cap companies. With an expense ratio often below 0.04%, these funds provide cost-effective exposure to overall market growth.

- S&P 500 ETF (SPY, VOO): Tracks the 500 largest U.S. companies by market capitalization. Historically, the S&P 500 has delivered an average annualized return of around 10% over the past 50 years, making it a cornerstone for many long-term portfolios.

- International Equity ETF (VXUS, VEU): Adds global diversification by investing in developed and emerging markets outside the U.S. Allocating 20–30% of your portfolio here can reduce home-country bias and capture growth in Europe, Asia, and Latin America.

- Bond ETF (BND, AGG): Provides stability and regular income through a diversified basket of U.S. investment-grade bonds. Including a 10–20% bond allocation can dampen portfolio volatility, especially during equity market downturns.

Fractional Shares: High-priced ETFs like BRK.B or high-demand tech funds can exceed $500 per share, putting them out of reach if you only have $50. Fractional-share investing lets you purchase a portion of a share—so you could allocate $25 to VOO and $25 to VXUS each month, rather than wait until you have enough to buy a full share.

Asset Allocation: A simple starter mix might be 60% equities (40% U.S. via VTI/SCHB, 20% international via VXUS/VEU) and 40% fixed income (BND/AGG). As your balance grows, you can fine-tune this mix based on your risk tolerance and time horizon, perhaps adding sector-specific ETFs (technology, healthcare) or alternative assets like REIT ETFs for real estate exposure.

Reinvestment of Dividends: Many ETFs pay quarterly dividends. By opting for automatic dividend reinvestment (DRIP), you ensure these payouts are used to purchase additional shares or fractions thereof—supercharging compound growth without extra effort.

You can model these allocations and simulate outcomes using our investment simulator. Simply input your $50 monthly contribution, choose your ETFs, and visualize projected balances over various market cycles.

Automating Your Contributions

Removing the guesswork and emotion from investing is crucial for staying on track with a $50-per-month plan. Automation does exactly that: once set up, your contributions happen like clockwork, regardless of market mood or personal distractions. Choose a date—often your payday or bill-pay day—so that funds are available and you never accidentally skip a transfer.

Most modern brokerages and robo-advisors offer automatic investment plans. Simply link your checking or savings account, specify $50 monthly, and select your target ETFs or funds. From that point on, the system debits your bank and invests directly—no login required. Some platforms even let you split that $50 across multiple accounts (e.g., $30 to your Roth IRA, $20 to a taxable account) in a single setup.

To tailor the timing and allocation, try our DCA Calculator. Input your risk profile, desired ETFs, and contribution amount; the tool returns an optimized schedule—down to which trading days minimize fees and maximize compounding. You’ll also see a clear cost breakdown, helping you choose the most fee-efficient days of month-end versus mid-month.

Beyond basic automation, our Premium DCA Calculator adds professional features:

- Auto-Rebalancing: Keeps your portfolio aligned with your target allocation—selling overweight positions and buying underweight ones without manual intervention.

- Tax-Loss Harvesting: Automatically identifies opportunities to sell depreciated holdings to offset gains, then reinvests proceeds to maintain market exposure.

- Custom Alerts: Notifies you if a contribution fails, if your allocation drifts beyond set bands, or when market conditions hit predefined thresholds.

A few best practices for automation success:

- Maintain a Cash Buffer: Keep at least one month’s $50 contribution in your bank account to avoid failed transfers.

- Review Annually: Even with full automation, schedule a yearly check—review performance, adjust contribution amounts as income grows, and update target allocations.

- Use Multiple Channels: Link both your bank’s bill-pay feature and your brokerage’s auto-invest tool for redundancy—so if one fails, the other still invests.

Automation transforms investing from a willpower challenge into a simple mechanical task. By combining this set-and-forget approach with our investment simulator for planning and the advanced capabilities of our Premium DCA Calculator, you’ll ensure your $50 monthly habit stays consistent—letting time and compound growth do the heavy lifting.

Managing Fees & Costs

When you’re investing just $50 a month, every dollar counts—and even seemingly tiny fees can chip away at your long-term returns. Over decades, a few basis points here and there compound into differences of thousands of dollars. To safeguard your growth, it’s essential to understand the various fee types, how they’re charged, and where you can minimize or eliminate them.

- Expense Ratios: This is the annual fee charged by a fund manager, expressed as a percentage of assets under management. Aim for total expense ratios below 0.20%. For example, a 0.10% ratio on a $6,000 portfolio costs $6 per year, whereas a 0.50% ratio costs $30—five times more. Over 20 years, that extra 0.40% can erode thousands of dollars from your balance.

- Trading Commissions & Platform Fees: Many brokerages now offer commission-free ETF and stock trades. Always confirm that your platform does not charge per-trade fees or inactivity/account maintenance fees. A single $4.95 commission on a $50 purchase represents a 9.9% drag before even factoring market movement.

- Bid/Ask Spreads: The difference between the purchase price (ask) and selling price (bid) can add hidden costs, especially in low-volume ETFs or niche funds. To minimize spread impact, choose highly liquid funds—like broad market ETFs (VTI, SPY)—where spreads are typically just one or two cents.

- Load Fees & Redemption Fees: Some mutual funds charge front-end or back-end loads (sales charges) or short-term redemption fees if you sell too quickly. Stick to no-load funds and ETFs, or check that any redemption fee only applies to redemptions under a 30- or 90-day holding period.

- Account Maintenance & Custody Fees: Avoid brokers that levy monthly or annual account fees, custodial fees, or platform subscriptions. Many modern robo-advisors and discount brokerages waive these for basic accounts—perfect for $50/month investors.

Example Impact: Imagine two ETFs, both tracking the S&P 500, but one has a 0.03% expense ratio (like VOO) and the other 0.40%. On a $12,000 balance after 20 years of $50/month investments at 7% annual returns, the lower-cost fund could leave you with approximately $24,500, versus $23,000 in the higher-cost fund—a difference of $1,500 from fees alone.

To model these scenarios, try our investment simulator. Input your $50 monthly contribution, specify different expense ratios, and see side-by-side projections. This hands-on comparison makes it clear why low-cost funds are non-negotiable for small, regular investors.

Strategies to Minimize Fees:

- Choose broad-market ETFs (e.g., VTI, SCHB) with expense ratios under 0.05%.

- Use brokerages that offer commission-free trading and no account minimums.

- Enable dividend reinvestment (DRIP) to avoid paying a commission on reinvested payouts.

- Consolidate accounts to avoid overlapping custody or platform fees.

If you want more automation around fee optimization—like tax-loss harvesting or dynamic fee analysis—consider our Premium DCA Calculator. It not only automates contributions but also scans for fee opportunities and executes harvests or rebalances on your behalf.

Ultimately, keeping costs low is one of the easiest levers you can pull as a beginner investor. By focusing on ultra-low expense ratios, commission-free platforms, and sensible trading practices, you ensure that your $50 monthly habit compounds toward your goals—rather than paying someone else to manage it.

Tracking Performance

Keeping an eye on your investments is essential to ensure your $50-per-month plan stays aligned with your goals—but constant monitoring can lead to emotional knee-jerk reactions. Instead, adopt a structured review cadence, such as quarterly or semi-annual check-ins, to evaluate progress without reacting to daily noise.

Start by logging three key metrics each review period:

- Cumulative Contributions: Total amount invested to date (e.g., $600 × number of months).

- Portfolio Value: Current market value of holdings, including reinvested dividends.

- Benchmark Comparison: Compare your portfolio’s Compound Annual Growth Rate (CAGR) against a relevant index (e.g., S&P 500 at ~7–10%).

Use tools that simplify data capture:

- WhatIfInvested Simulator dashboard to visualize contributions vs. returns.

- Free portfolio trackers like Google Sheets with automated API pulls (e.g., Alpha Vantage) or apps such as Personal Capital.

- Our DCA Calculator for an exportable schedule and performance history.

During each review, investigate any variances:

- Underperformance: Check if high expense ratios or sector concentration are dragging returns.

- Allocation Drift: If equities rise to 70% of your portfolio when your target is 60/40, consider rebalancing.

- Drawdowns: Assess your maximum drawdown and ensure it remains within your risk tolerance.

Automate your workflow by setting calendar reminders—export statements, update your sheet or dashboard, and note any action items (e.g., rebalance, increase contribution). This ritual maintains engagement and discipline without daily market anxiety. If you prefer a fully hands-off solution, our Premium DCA Calculator can generate automated performance reports, rebalance notifications, and customized alerts to keep you informed and on track.

Rebalancing & Adjusting Over Time

As your portfolio grows, market movements will inevitably cause some assets to outperform others, pushing your allocation away from its original targets. For instance, equities may rally faster than bonds, increasing your stock weighting and exposing you to higher volatility than intended. Rebalancing is the disciplined process of selling portions of those overweighted holdings and redirecting the proceeds into underweight assets, thereby “selling high” and “buying low” to maintain your desired risk profile.

There are two common rebalancing approaches:

- Calendar-Based: Rebalance on a fixed schedule—annually, semi-annually, or quarterly. This simplicity ensures you revisit your portfolio regularly, but may incur unnecessary trades if markets are relatively stable.

- Threshold-Based: Set tolerance bands (e.g., ±5% or ±10% around each target allocation). Only rebalance when an asset class drifts beyond these bands, reducing transaction costs by trading only when meaningful imbalances occur.

To determine the optimal frequency and thresholds for your $50/month plan, use our investment simulator. Backtest different rebalance rules over historical data and compare how each affects your final portfolio value, turnover costs, and drawdown characteristics. You’ll gain insights into the trade-off between staying tightly aligned to targets and minimizing fees.

For hands-off investors, our Premium DCA Calculator automates rebalancing according to your chosen schedule or threshold rules. It monitors your holdings daily, executes partial trades to realign weights, and provides detailed reports—all without manual intervention.

Beyond rebalancing, you should also periodically adjust your contribution amount and allocation as your financial situation evolves. If you receive a raise, consider increasing your monthly investment to $75 or $100 to accelerate wealth accumulation. If you develop new goals—such as saving for a child’s education or adding a real estate exposure—reallocate a portion of your future $50 contributions into targeted ETFs like REIT funds or sustainable investing vehicles.

Finally, integrate rebalancing into your annual financial checkup:

- Review performance and allocation drift in your quarterly or yearly portfolio review.

- Update your target allocations if your risk tolerance or time horizon change (e.g., as you approach retirement).

- Use our blog resources and methodology guides to refine your approach based on new market research or tax considerations.

By combining systematic rebalancing, regular contribution increases, and clear adjustment rules, you ensure that your modest $50 monthly habit remains optimally allocated and continues to harness the power of compounding—without letting market drift undermine your long-term goals.

Tools & Resources

Navigating the investing landscape is much easier when you leverage the right tools. Below is a curated list of both free and premium resources designed to simplify every step of your $50/month plan—from modeling scenarios and automating contributions to monitoring performance and optimizing costs. Each tool integrates seamlessly with our methodology, helping you stay disciplined and focused on long-term growth.

- WhatIfInvested Simulator: This interactive web app allows you to backtest dollar-cost averaging versus lump-sum strategies across multiple asset classes. Input your $50 monthly contributions, select ETFs or mutual funds, and instantly visualize historical portfolio trajectories. The simulator displays drawdowns, peak-to-valley declines, and recovery periods, giving you a clear understanding of risk and reward trade-offs. Use filters to compare bull, bear, and sideways markets, and export detailed charts for your own records.

- WhatIfInvested DCA Calculator: Designed specifically for automated investors, this free tool generates a personalized schedule for regular contributions. Enter your target allocation percentages, anticipated fees, and a start date—then watch as the calculator outlines exact trade dates, amounts, and periodicity. It also highlights how small changes in timing (e.g., contributing on the 1st vs. the 15th) affect long-term returns, helping you minimize transaction costs and maximize compounding.

- Premium DCA Calculator: For those seeking professional-grade automation, our premium offering includes advanced features like auto-rebalancing, tax-loss harvesting, and customizable alerts. It connects directly to most major brokerages via secure API integrations, executing trades on your behalf according to pre-set rules. The platform analyzes your portfolio daily, identifies drift beyond your tolerance bands, and rebalances automatically—ensuring you stay aligned with your risk profile without lifting a finger.

- Wealthsimple: A beginner-friendly brokerage that offers no minimum balances, zero commission trades, and fractional-share investing. Whether you want to split your $50 monthly contribution across multiple ETFs or reinvest dividends automatically, Wealthsimple’s intuitive mobile and web apps make it straightforward. Their tax-loss harvesting feature and round-up spare-change investing further complement the tools above, providing a holistic automated investing experience.

In addition to these platform-specific resources, consider pairing them with complementary tools like financial planning spreadsheets or personal finance apps (e.g., Mint, Personal Capital) to track cash flows and net worth. Regularly reviewing aggregate data helps you spot trends, adjust your $50 contributions when your budget changes, and maintain motivation by seeing your progress in real time.

Finally, dive deeper into strategy and psychology by exploring our blog, reading our methodology section, or checking out industry-standard resources like the CFA Institute’s behavioral finance articles. Armed with the right tools and knowledge, your modest $50 monthly habit transforms into a powerful engine for long-term wealth creation.

FAQs & Additional Resources

1. Is $50 per month enough to start investing?

Absolutely. The most important factor in long‐term wealth building is consistency, not the size of each individual contribution. By investing $50 every month through dollar‐cost averaging, you buy more shares when prices are low and fewer when they’re high, smoothing out volatility. Over decades, even small monthly investments can compound into significant sums. Plus, starting with $50 builds your investing habit and confidence – you can always increase contributions as your income grows.

2. What’s the best way to handle market downturns?

Downturns are inevitable, but they also present buying opportunities. Rather than halting contributions, maintain your $50 monthly plan – you’ll purchase additional shares at discounted prices, lowering your average cost per share. Historical data shows that markets recover over time; the key is staying invested. If you feel anxious, revisit long‐term performance charts in our investment simulator to see past recoveries and reinforce discipline.

3. How do I increase my contributions?

As your financial situation improves, consider gradually raising your monthly investment. Tie increases to pay raises, tax refunds, or bonuses to make the hike feel effortless. Even a $10 or $25 bump compounds meaningfully over time. For example, increasing from $50 to $75 per month at age 30, at a 7% return, can add tens of thousands to your retirement nest egg by age 60. Track your progress in a spreadsheet or with our DCA calculator to celebrate milestones.

4. Can I mix individual stocks with index funds?

Yes—mixing a small allocation of individual stocks (e.g., 10–20%) with broad market ETFs can enhance potential returns while maintaining diversification. Limit single‐stock exposure to what you’re comfortable potentially losing, and keep core holdings in low‐cost index funds like VTI or SPY. Monitor individual positions to avoid excessive concentration risk, and rebalance periodically to maintain your target allocation.

5. What tax implications should I consider?

Contribution accounts dictate your tax treatment. In a Roth IRA or TFSA, contributions are post‐tax but grow and withdraw tax‐free. Traditional IRAs, RRSPs, and 401(k)s offer upfront deductions but taxable distributions. Taxable brokerage accounts have no contribution limits but incur annual taxes on dividends and realized gains. To minimize drag, use tax‐efficient ETFs and hold high‐yield assets in tax‐advantaged accounts when possible.

6. Where can I learn more about investing?

Deepen your knowledge through reputable sources:

- Our blog for practical guides and case studies.

- The CFA Institute’s behavioral finance articles.

- Books such as The Psychology of Money by Morgan Housel and The Intelligent Investor by Benjamin Graham.

- Online courses on Coursera or edX covering personal finance and portfolio management.

Recommended Books & Partner Links

- Money: Master the Game by Tony Robbins

- Rich Dad Poor Dad by Robert Kiyosaki

- The Psychology of Money by Morgan Housel

- The Intelligent Investor by Benjamin Graham

Related Articles

Conclusion

Investing just $50 a month may seem modest, but consistency compounds into remarkable results over time. By committing to regular contributions, you harness the dual powers of dollar-cost averaging and compound growth—buying more shares when prices dip and letting returns generate returns on already-invested funds. This disciplined habit is the cornerstone of long-term wealth building.

Setting clear goals—whether for retirement, a home down payment, or an emergency fund—gives purpose to each dollar you invest. Choosing the right accounts (Roth IRA, TFSA, or taxable brokerage) maximizes tax efficiency, while selecting low-cost ETFs ensures you keep more of your returns. Automating your $50 transfer removes emotion and timing risk from the equation.

Managing fees is equally critical. By favoring ultra-low expense ratios and commission-free platforms, you protect your gains from being eroded by costs. Periodic rebalancing and performance reviews help you stay aligned with your target allocation, while incremental increases to your monthly contribution accelerate progress as your income grows.

Leverage the tools we’ve discussed—our investment simulator to visualize scenarios, the DCA calculator to generate schedules, and the Premium DCA Calculator for advanced automation—to reinforce your strategy and keep you on track.

Remember, the most powerful variable in investing isn’t timing or talent—it’s time itself. Start today, stick to your plan, and let the markets and your disciplined contributions work together. Over years and decades, your $50-per-month habit can transform into a substantial nest egg, unlocking financial freedom and peace of mind for your future self.