🪙 Bitcoin vs Gold (2015–2025): Store of Value ROI, Volatility & How to Allocate

Updated August 14, 2025 • 14‑minute read • Comparison

Introduction: why the keyword “bitcoin vs gold” is more than a meme

The bitcoin vs gold debate isn’t just internet banter—it’s a real asset‑allocation question. You’re comparing a millennia‑tested precious metal to a digitally scarce network asset with a hard cap on supply. This guide goes beyond headlines to unpack what matters for long‑term savers: total return (ROI) from 2015–2025, volatility and Sharpe ratio, and how each behaves inside a diversified portfolio.

What searchers really want

- “Is Bitcoin outperforming gold in 2015–2025?”

- “Which is the better store of value in an inflationary world?”

- “How much of each should be in a balanced portfolio?”

What this analysis covers

- ROI & drawdowns across macro regimes

- Risk‑adjusted returns (volatility, Sharpe)

- Correlation & role alongside stocks/bonds

How to use it

- Pick an allocation that fits your time horizon

- Automate contributions (DCA) and rebalancing

- Choose custody that matches your risk tolerance

A quick TL;DR of Bitcoin vs Gold: Bitcoin historically delivered higher returns but with larger and faster price swings; gold compounded more modestly while smoothing portfolio drawdowns. Depending on your risk budget, the best choice might be both, in different weights.

Data & methodology at a glance

- Window: Jan 2015 → Apr 2025 (to align with common retail investor timelines).

- Return math: Lump‑sum ROI and rolling returns (with illustrative DCA notes).

- Risk metrics: Annualized volatility, Max Drawdown, and simple Sharpe vs a cash proxy.

- Note: Figures are educational and periodically revised—always verify with your broker or trusted data vendor.

How to read the charts

Price‑indexed ROI lines highlight relative compounding. Volatility and drawdown panels show the “emotional cost” of holding. If you’re a set‑and‑forget investor, pair this with dollar‑cost averaging and rebalancing to tame timing risk. Try the Investment Simulator or DCA Calculator.

What makes an asset a store of value?

A credible store of value preserves purchasing power across time and regimes. In the bitcoin vs gold comparison, both score well on some traits and diverge on others. Below, we break down the core criteria and what they imply for real‑world investors.

1) Scarcity & issuance

- Gold: Geologic scarcity; above‑ground stock grows slowly via mining. Supply reacts to price with long lags.

- Bitcoin: Programmatic scarcity; supply capped at 21M with issuance that halves roughly every four years. Fully transparent, schedule known.

- Investor takeaway: Gold’s scarcity is physical and path‑dependent; Bitcoin’s is deterministic—useful for long‑horizon planning.

2) Durability & custody

- Gold: Chemically stable and physical; custody involves vaults, insurance, and transport logistics.

- Bitcoin: Digital bearer asset; durability rests on network security and key management (hardware wallets, multisig).

- Investor takeaway: Gold’s durability is tangible; Bitcoin’s requires operational hygiene. Both are viable with good custody habits.

3) Divisibility & portability

- Gold: Divisible but impractical for micro‑transactions; cross‑border portability can be costly and regulated.

- Bitcoin: Divisible to 1 satoshi (0.00000001 BTC); global, near‑instant settlement with predictable fees (layer‑2 can reduce costs).

- Investor takeaway: For rapid, borderless portability, Bitcoin is superior; for large, infrequent transfers, both work with proper channels.

4) Verifiability & authenticity

- Gold: Purity assays and chain‑of‑custody records reduce counterfeit risk but add process overhead.

- Bitcoin: On‑chain verification is binary (valid/invalid). Provenance and supply are auditable by anyone.

- Investor takeaway: Bitcoin’s verification is software‑native; gold relies on industrial standards and trusted intermediaries.

5) Acceptance & market depth

- Gold: Deep, global market with central banks, jewelry, and ETFs; long track record as crisis hedge.

- Bitcoin: Rapidly growing institutional and retail presence; liquidity varies by venue, with 24/7 markets.

- Investor takeaway: Gold’s acceptance is universal today; Bitcoin’s is expanding, with improving on‑ramps and regulated products.

| Criterion | Gold | Bitcoin | Implication |

|---|---|---|---|

| Scarcity | Natural, slow supply growth | Hard cap (21M), halving cycle | Both scarce; BTC supply is fully predictable |

| Durability | Physical, corrosion‑resistant | Network‑level durability; key security required | Custody risk differs: vaults vs keys |

| Divisibility | Limited for everyday use | 8‑decimal precision (sats) | BTC easier for small, frequent increments |

| Portability | Costly cross‑border, slower | Global, 24/7 settlement | BTC wins on cross‑border agility |

| Acceptance | Centuries‑long track record | Growing adoption, regulated products | Gold is entrenched; BTC trend is rising |

When gold shines

- Flight‑to‑quality during systemic stress

- Ultra‑low tolerance for mark‑to‑market swings

- Institutional mandates that require off‑chain custody

When Bitcoin shines

- Long horizons with high return targets

- Borderless portability and programmable settlement

- Willingness to rebalance through drawdowns

Practical next step: model a blended allocation. Use our Investment Simulator to compare 5–10% gold vs 1–5% Bitcoin tilts against your base 60/40 or equity index core, then stress‑test rebalancing rules.

Bitcoin overview (2015–2025)

Over the past decade, Bitcoin has moved from a fringe experiment to a globally traded asset with institutional presence. In 2015, BTC traded below $300; by late 2017, the first major speculative wave took it near $20,000 before retracing over 80%. This pattern—rapid expansions followed by sharp contractions—has repeated each halving cycle, driven by new adoption, speculative capital, and liquidity shifts.

Key price drivers

- Halving cycles: Every ~4 years, the block subsidy halves, reducing new supply and often preceding major rallies.

- Macro liquidity: Easy monetary policy and low real yields have historically supported risk-on assets, including BTC.

- Institutional entry: Products like Bitcoin ETFs (spot and futures) have broadened access and liquidity.

- Network effects: Growth in active addresses, Lightning Network usage, and integration with payment rails enhances utility.

- Regulatory stance: Clearer frameworks in some regions (e.g., U.S. ETF approvals) and restrictions in others (e.g., China bans) affect sentiment.

In the bitcoin vs gold comparison, Bitcoin’s ROI from 2015–2025 has dwarfed that of gold, but it has done so with volatility often exceeding 60% annualized. This creates both extraordinary compounding potential and significant psychological stress for holders.

Gold overview & key price drivers

Gold has served as a store of value for millennia, prized for its scarcity, durability, and universal acceptance. Between 2015 and 2025, it has seen measured gains, rising from the ~$1,100/oz range to over $2,000/oz at cycle peaks. While its nominal return trails Bitcoin, gold’s role in the bitcoin vs gold debate is as a stabilizer during market turmoil and an anchor against inflation.

Key price drivers

- Real interest rates: Falling real yields make non-yielding assets like gold more attractive.

- U.S. dollar strength: Gold typically moves inversely to the USD Index (DXY).

- Central-bank demand: Emerging-market central banks have been net buyers, diversifying reserves away from the USD.

- Risk sentiment: In crises (pandemic, geopolitical shocks), gold tends to benefit from safe-haven flows.

- Inflation expectations: Persistent inflation pressures increase gold’s perceived necessity in portfolios.

Unlike Bitcoin, gold’s volatility is generally below 15% annualized. In multi-asset portfolios, this makes it a valuable diversifier, smoothing returns when equities or cryptocurrencies experience sharp drawdowns.

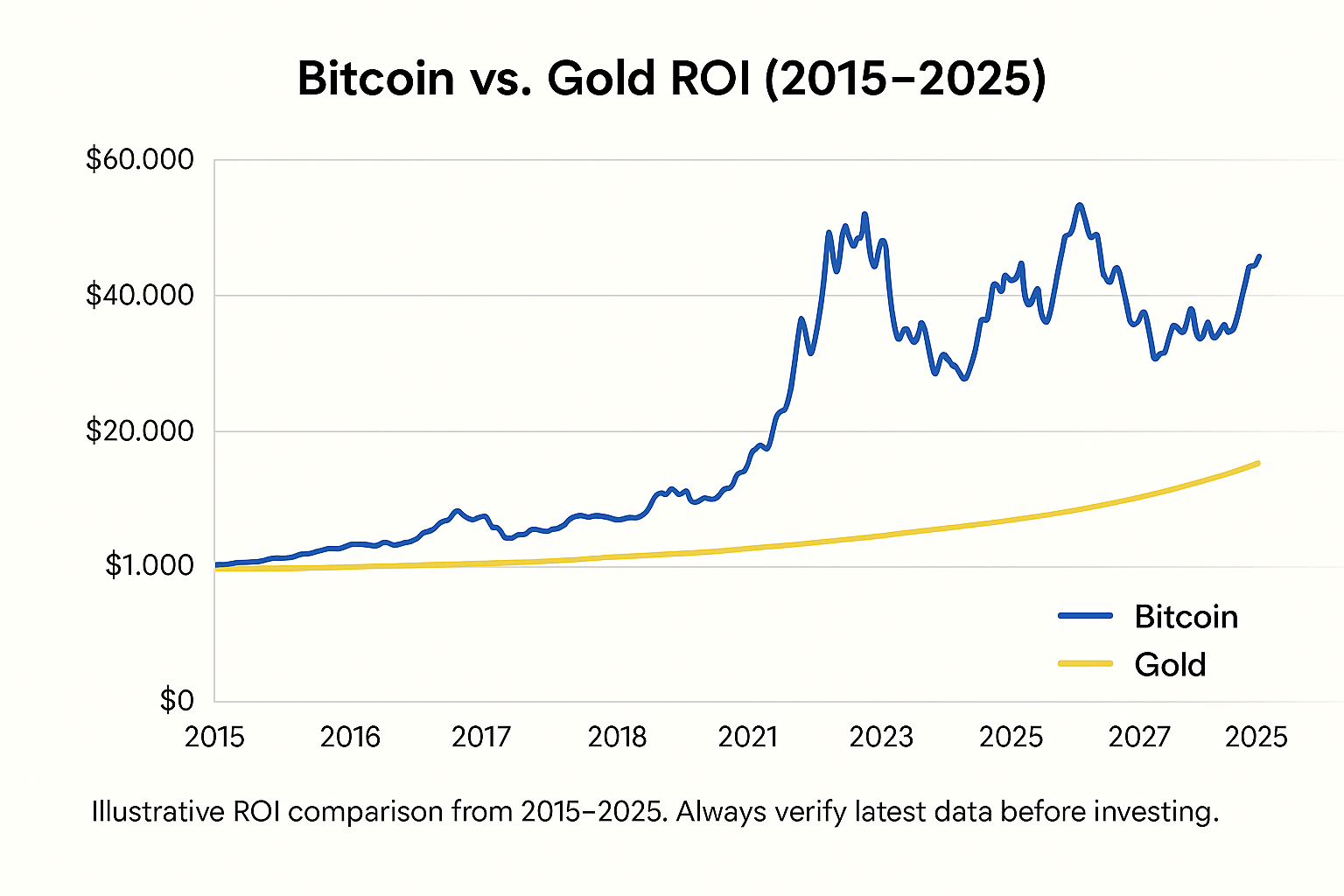

Bitcoin vs Gold ROI (2015–2025)

To illustrate the performance gap, imagine investing $1,000 on January 1, 2015 and holding until April 1, 2025, without adding or withdrawing funds. This comparison highlights why “bitcoin vs gold” remains a hotly debated topic among both retail and institutional investors.

- Bitcoin: Transformed $1,000 into a multi-six-figure sum at peak, with several drawdowns exceeding −70% along the way. Returns have been explosive but require extreme risk tolerance.

- Gold: Grew $1,000 to roughly $1,800–$2,000 over the same period, with far smaller drawdowns, preserving capital through crises.

Key observations

- Bitcoin’s outperformance in ROI terms is unmatched, but volatility magnifies behavioral risks.

- Gold’s steadiness allows for better sleep at night and lower sequence-of-returns risk.

- Blending both assets in small allocations can improve portfolio efficiency (higher Sharpe ratio).

Note: Figures are illustrative and rounded. Always confirm live market data and methodology before making investment decisions. Consider running both lump-sum and DCA scenarios in our Free Investment Simulator.

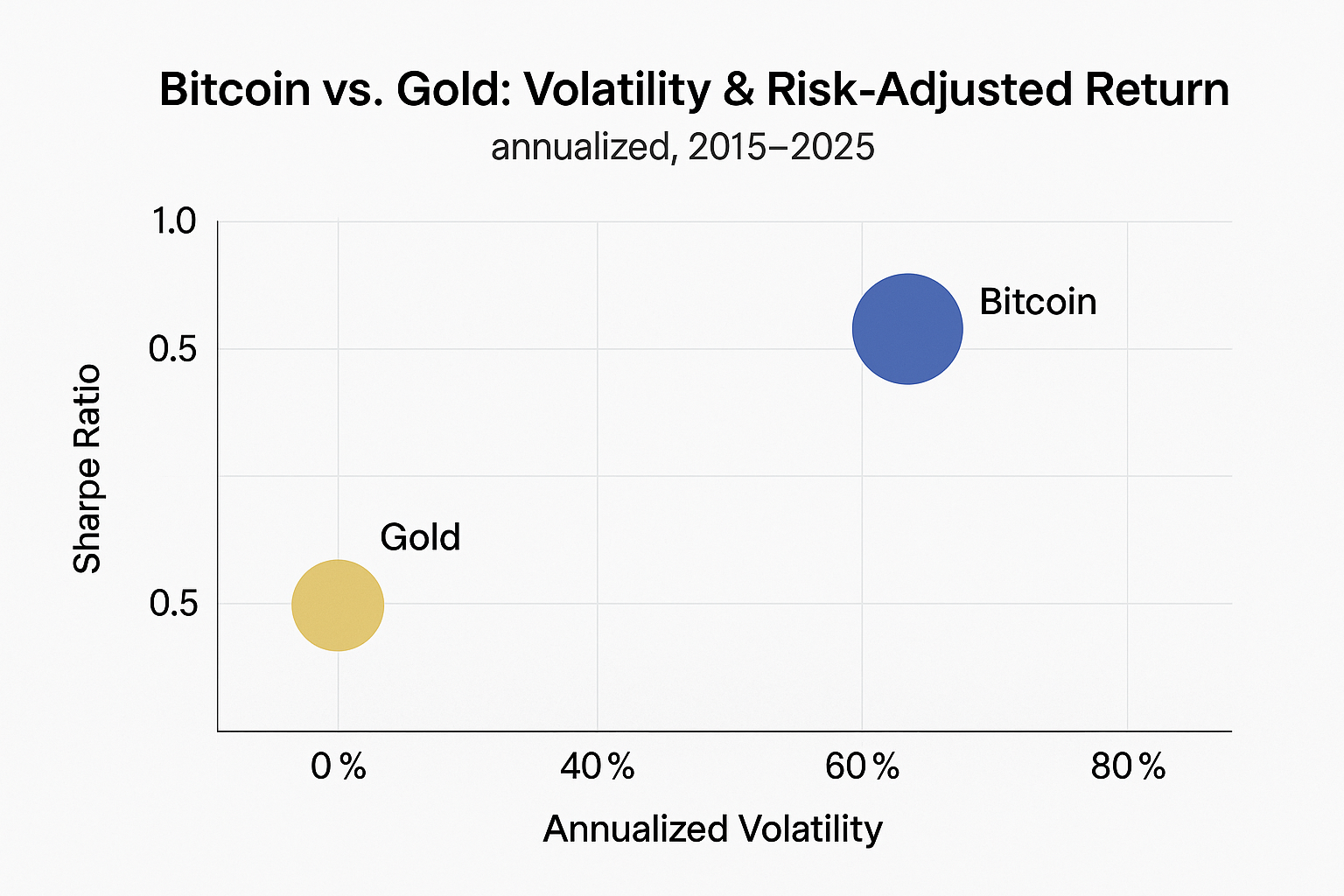

Volatility, drawdowns & Sharpe: risk in “bitcoin vs gold”

In the bitcoin vs gold debate, the biggest differentiator isn’t just returns—it’s how each asset behaves under pressure. Understanding volatility, maximum drawdowns, and the Sharpe ratio helps investors decide the right allocation for their risk tolerance.

1. Volatility

Annualized volatility for Bitcoin has often exceeded 60%–80% during the last decade, compared to gold’s 10%–15%. This means Bitcoin prices can swing dramatically in days, while gold tends to move more slowly, acting as a portfolio stabilizer.

2. Drawdowns

Bitcoin’s largest peak-to-trough drops have exceeded −70% in bear markets (e.g., 2018, 2022), requiring exceptional conviction to hold through. Gold’s worst drawdowns over the same period have been in the −10% to −20% range, offering more capital preservation during crises.

3. Sharpe Ratio (Risk-Adjusted Return)

Despite higher volatility, Bitcoin has historically posted a higher Sharpe ratio over full market cycles, meaning it has delivered more return per unit of risk. Gold’s Sharpe ratio is lower, but steadier, reflecting its role as a consistent store of value.

Investor takeaway

- Sizing beats timing: Even a 1%–5% Bitcoin allocation can materially boost portfolio returns over a decade.

- Diversification works both ways: Gold can dampen volatility in crypto-heavy portfolios.

- Rebalancing is key: Trim after major rallies and add in periods of extreme pessimism.

Data based on historical trends 2015–2025. Future performance is uncertain; consider running simulations using our Free Investment Simulator to test different allocation and rebalancing strategies.

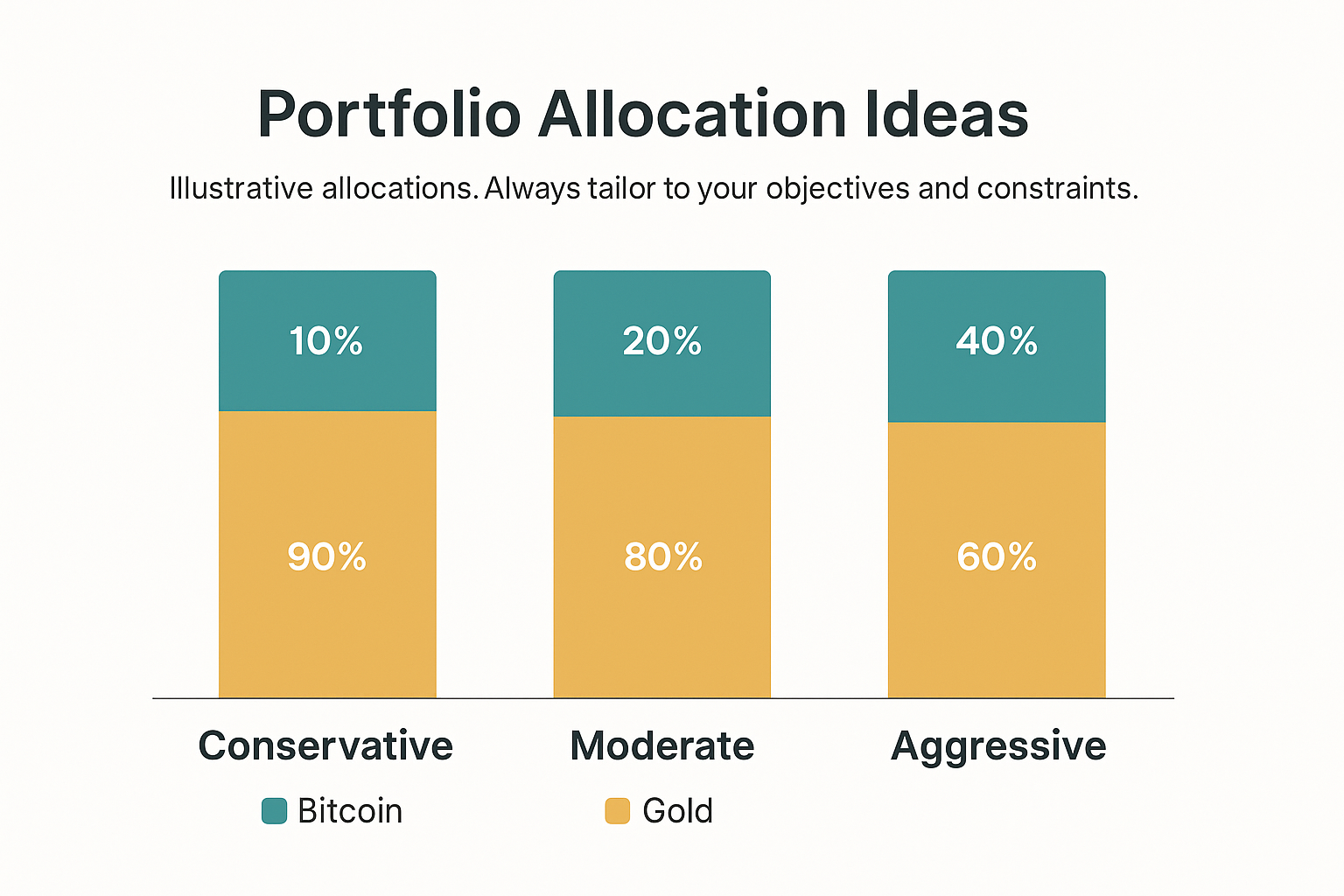

Portfolio allocation ideas for “bitcoin vs gold” investors (illustrative)

When comparing bitcoin vs gold as part of a broader investment strategy, the right mix depends on your risk tolerance, time horizon, and conviction in each asset’s role as a store of value. Below are illustrative allocation ranges based on different investor profiles:

- Conservative hedge: 0–2% BTC • 5–10% Gold — Focus on capital preservation while adding a small crypto exposure for upside.

- Balanced: 2–5% BTC • 5–10% Gold — Seeks moderate growth while maintaining a protective gold position.

- Growth tilt: 5–10% BTC • 3–8% Gold — Prioritizes higher potential returns by allocating more to Bitcoin.

These allocations are not recommendations, but starting points for further research. Test custom mixes with our Investment Simulator or DCA Calculator to see historical performance, volatility, and income projections.

Practical considerations when holding Bitcoin and Gold

1. Liquidity & Access

Gold: Physical gold requires secure storage and insurance, while ETFs (e.g., GLD, IAU) offer simplicity but include management fees. Bitcoin: Trades 24/7 globally, with settlement times ranging from seconds (Layer 2) to minutes (on-chain). Prioritize reputable exchanges and consider hardware wallets for long-term custody.

2. Tax & Compliance

Tax treatment for bitcoin vs gold varies by jurisdiction. Some countries tax capital gains on both, while others treat gold as a collectible or apply different rates. Keep meticulous records of:

- Purchase dates and prices

- Sale dates and proceeds

- On-chain transactions and mining income (for Bitcoin)

3. Costs

Gold: Storage fees for vaulted gold can range from 0.1%–0.5% annually, while ETFs carry MERs between 0.15%–0.40%. Bitcoin: Exchange trading fees typically range from 0.05%–0.5% per trade; on-chain transactions may include network fees that vary with demand. Long-term holders often minimize costs by reducing trading frequency.

Key takeaway

While bitcoin vs gold allocations can diversify a portfolio, operational details—such as custody, taxation, and cost structure—will significantly affect your net returns.

Related guides to explore after “bitcoin vs gold”

If you found this bitcoin vs gold analysis helpful, you may also enjoy these related strategy guides and tools. They dive deeper into portfolio building, timing strategies, and long-term wealth planning.

- Lump Sum vs DCA — Which Works Best? Compare the pros and cons of investing a large amount at once versus spreading it out over time.

- Bitcoin Halving Simulator See how Bitcoin’s programmed supply cuts have impacted price cycles and volatility.

- Portfolio Back-tester Model your own asset mixes — including Bitcoin, Gold, and ETFs — to see historical performance and drawdowns.

FAQ — Bitcoin vs Gold

Is Bitcoin better than gold as a store of value?

Over full market cycles, Bitcoin has historically delivered higher returns than gold, but with meaningfully higher volatility and deeper drawdowns. Gold has been a steadier hedge during stress and rate‑shock regimes.

Rule of thumb: If you value upside and can tolerate volatility, a small Bitcoin sleeve can be additive. If you prioritize wealth preservation and low correlation to equities, gold remains a core hedge.

How much Bitcoin vs Gold should I hold?

Illustrative ranges based on risk budgets:

- Conservative: 0–2% BTC • 5–10% Gold

- Balanced: 2–5% BTC • 5–10% Gold

- Growth tilt: 5–10% BTC • 3–8% Gold

Size positions so a normal drawdown in Bitcoin doesn’t derail your plan. Revisit annually or when allocations drift 5–10% from target.

Does Bitcoin really act like “digital gold”?

Bitcoin encodes scarcity (21M cap), divisibility (satoshis), and portability (global settlement) in software. Market behavior can still diverge from gold, especially during liquidity crunches when risk assets correlate. Treat Bitcoin as a complementary store‑of‑value candidate, not a 1:1 substitute for gold.

What about taxes on Bitcoin vs Gold?

Tax treatment varies by country. Many jurisdictions treat both as property with capital gains on disposal. Some treat certain forms of gold as “collectibles,” with different rates. Keep accurate cost‑basis records and confirm local rules before transacting.

This is general education, not tax advice. Consult a qualified professional.

Is DCA better than a lump sum for Bitcoin or Gold?

Dollar‑cost averaging (DCA) reduces timing risk and behavioral errors, which is helpful with Bitcoin’s higher volatility. Lump sum often wins on average in rising markets but can feel painful if followed by a drawdown. Test both paths with our DCA Calculator.

How do correlations differ for bitcoin vs gold?

Gold tends to exhibit low or negative correlation to equities in flight‑to‑safety episodes, cushioning multi‑asset portfolios. Bitcoin’s correlation shifts over time and can rise during risk‑on/risk‑off swings. Mixing both can diversify shocks from different macro drivers.

What are the main custody options for each asset?

Gold: Physical bars/coins (vaulted or at home), allocated/unallocated storage, or gold‑backed ETFs. Consider storage, insurance, and audit practices.

Bitcoin: Self‑custody hardware wallets (you hold the keys), reputable custodians/exchanges, or spot Bitcoin ETFs where available. Prioritize key security, 2FA, allow‑listing, and withdrawal policies.

What fees should I expect with bitcoin vs gold?

Gold: Bid‑ask spreads, dealer premiums, storage/insurance (for vaulting), and ETF MERs.

Bitcoin: Exchange trading fees, potential on‑chain network fees for withdrawals, and ETF MERs where applicable. All fees compound over time—optimize where possible.

How should I rebalance between Bitcoin and Gold?

Pick a cadence (e.g., annually or semi‑annually) and a band (e.g., 5–10% drift). Use fresh contributions and distributions first (“rebalance by buying”). If selling, be mindful of taxes and spreads.

Our Portfolio Back‑tester helps visualize outcomes across rebalancing rules.

Could I lose everything with Bitcoin? What about Gold?

Bitcoin: Smart‑contract exploits aren’t relevant to native BTC, but exchange failures, phishing, and key loss are real operational risks. Mitigate with hardware wallets, backups, and reputable venues.

Gold: Physical theft and counterfeit risk exist if storage and sourcing are poor. Vaulting with reputable providers and assay/serial verification reduces risk.

Conclusion: balance “bitcoin vs gold” to fit your plan

The debate isn’t binary. Gold offers time‑tested crisis insurance, low correlation, and stability. Bitcoin offers programmable scarcity, high portability, and asymmetric upside—tempered by greater volatility and operational considerations. Your mix should reflect your risk budget, time horizon, and rebalancing discipline.

When gold may deserve the edge

- You need portfolio ballast against rate shocks and recessions.

- You prioritize lower drawdowns and simpler custody.

- You already have substantial equity/crypto risk and want a counterweight.

When Bitcoin may deserve the edge

- You seek long‑run upside and can tolerate volatility.

- You’re comfortable with self‑custody or vetted custodians/ETFs.

- You’ll automate DCA and rebalance to keep risk in check.

Next step

Model your bitcoin vs gold mix and rebalancing rules with the Investment Simulator, or go deeper with the Premium DCA Calculator. Aim for a position size you can hold through a full cycle—not just during rallies.

Education only — not investment advice. Verify live data and consider professional guidance.